For a while, fiat or paper money remained the preferred means of payment for transactions in South Africa, according to the Global Cash Index study released in June 2017. To follow the cash drop in other global markets, companies like MTN tried to introduce alternative payment methods from as early as 2016 and fell flat on their face. In a report by Lynsey Chutel published on September 16, 2016, MTN is said to have announced the decommissioning of their mobile money service due to lack of commercial viability.

Leading retailers like Makro took up the challenge and started introducing various payment methods in their shops. From UCount to PayU, Makro’s intention was to divert customers’ focus from using paper money to cards so that they could also drive sales on their online platform. They stuck to their guns and fast forward to 2021; their online mission is more than thriving.

As the world plunged into pandemic lockdown in 2020, consumers adjusted their purchasing patterns to embrace contactless tap-and-go payments and internet shopping. Likewise, as storefronts shut down and social distance grew, retailers all over the world embraced e-commerce and transferred their companies online.

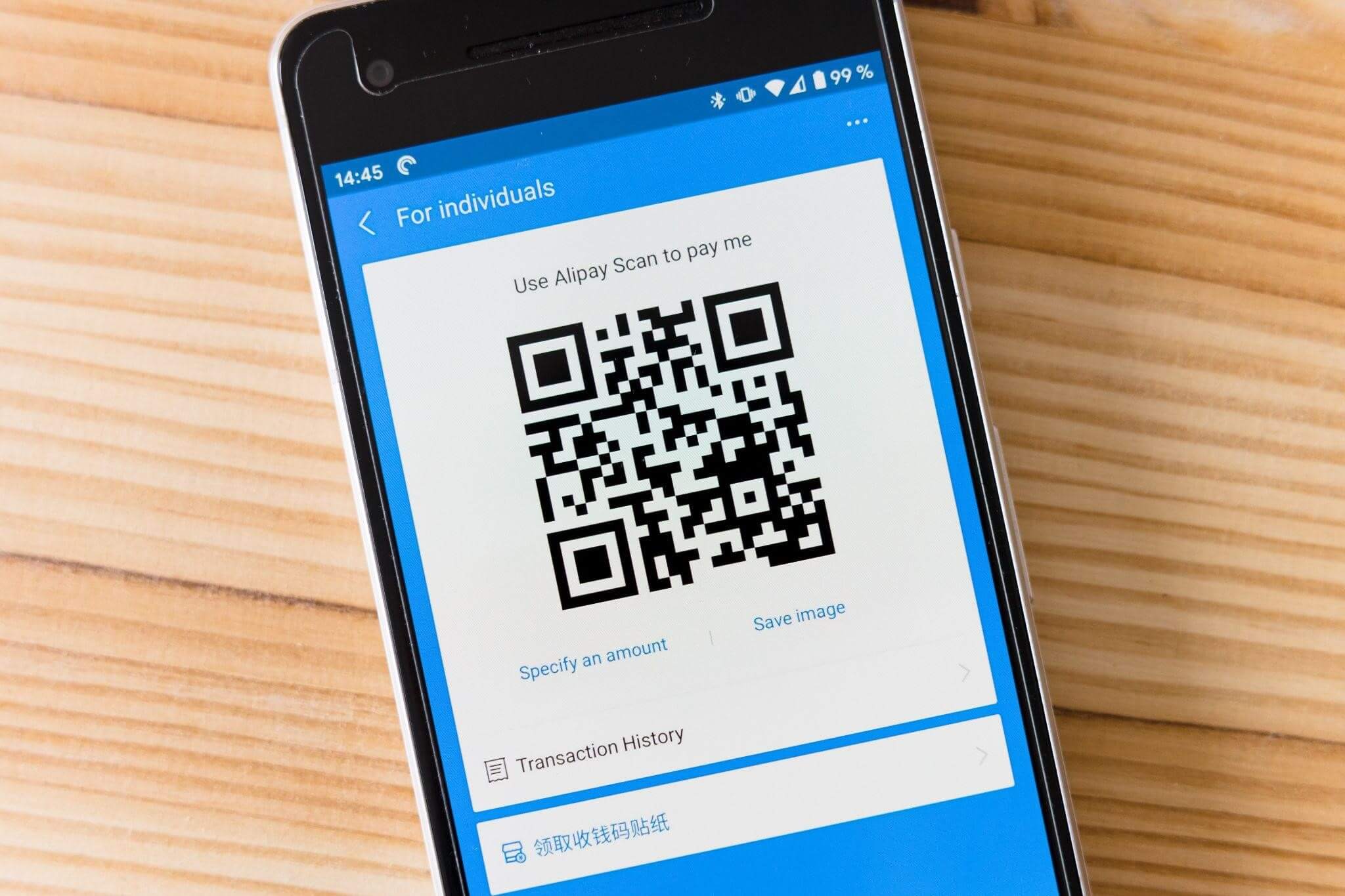

Recently, Mastercard released a new report highlighting South Africa’s growing appetite for digital payments as well as the rapid use of innovative payment technology. MTN bounced back and reintroduced MoMo, their mobile banking service. First National Bank (FNB) and Absa also introduced mobile payment offers. All three companies have reported usage increase as more customers see mobile payment as a more secure way of transacting and paying for services during the lockdown. According to the payment service provider, DPO SA, QR-code-based mobile wallets like Zapper and SnapScan are also enjoying tremendous growth during this time.

Bank Zero and TymeBank, South Africa’s first fully digital banks, recently opened their doors. Some older banks are also catching up with the digital age, eliminating some of their branches in order to attract customers to their digital offerings. Based on the Mastercard New Payments Index, 95% of South African customers will explore using at least one innovative payment method in the coming year, such as contactless payments, cryptocurrency, biometrics, or QR codes. Over two-thirds of respondents (66%) say they’ve tried a different payment method they wouldn’t have tried otherwise, but the pandemic has prompted them to try more flexible options.

As consumers seek to avoid potential hygiene hazards associated with touching banknotes, digital wallets such as CBA Tap & Pay, Apple Pay, Google Pay, Samsung Pay, Fitbit Pay, and Garmin Pay have seen considerable growth globally in the last month. Fears of getting the coronavirus are expected to drive more people to use mobile-based payments, including those who had not considered it previously.

While no one knows if more lockdowns will be implemented, we have realised that consumers are becoming increasingly comfortable transacting through digital channels, and we expect this trend to continue even when the lockdown is eventually fully lifted.

Image Courtesy: Clay Banks on Unsplash