Home Loan Bond Calculators Guide – you need to understand the costs involved and how much you can afford before you make the final decision to buy a property. This is where the “Bond Calculator” tool comes in. The Bond Calculator tools can help home owners estimate the monthly repayments based on the chosen term and home loan amount, as well as other costs that you need to be aware of when financing a new home. Additionally, Home Loan Bond Calculators can also help home owners check how additional monthly bond payments or a lumpsum payment can affect the reduction in their loan term and save them interest.

ALSO READ: How to search property for sale & rent in South Africa using Property24

What Is A Bond Calculator?

A Bond Calculator is an online tool that helps potential homeowners or home owners determine their monthly repayments on a property, the total repayment amount and the total interest you will pay. When buying property, It is important to use a Bond Calculator so that you will know how much money you will need to pay for your bond every month. Bond Calculator Repayment tool also helps you see affordability.

How To Use Bond Affordability Calculator?

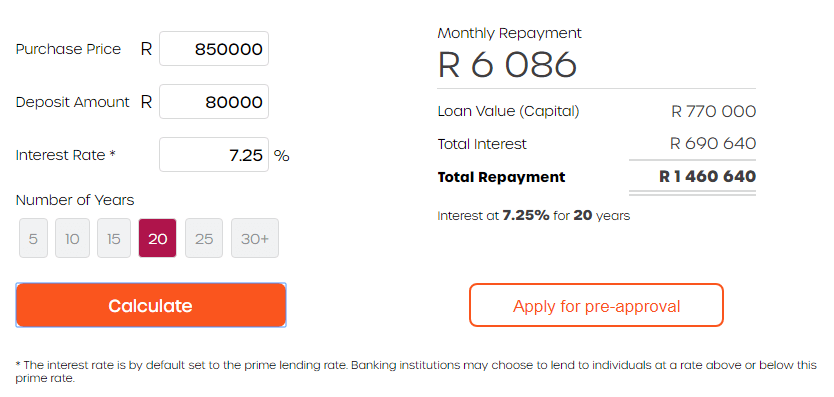

What will your home loan repayments be? In order to check your bond calculator affordability, you will need to input the Purchase Price, Deposit Amount, Repayment Term and Interest Rate. After entering these four factors into the bond calculator, you will be able to determine your bond repayment.

- Purchase Price – The purchase price is the price of the property that a buyer is interested in buying.

- Deposit Amount – A deposit amount is a sum of money which is part of the full price of the property, and which you pay when you agree to buy it.

- Repayment Term – The repayment term is the amount of time that you choose to repay the bank for the property, bond or debt obligation. Most bonds are over a period of 20 years, but you can choose a shorter term such as 15 years or 10 years.

- Interest Rate – The Interest rate is the rate at which the bank lends you the money to buy a property. Some define an Interest rate as the amount of interest due per period, as a proportion of the amount lent, deposited or borrowed.

How To Use Bond Repayment Calculator

What is a bond affordability calculator? A bond affordability calculator is an online tool which uses your monthly income to calculate the maximum home loan amount that a bank could borrow you to purchase a house. This tool is helpful because it helps you know how much your bond repayment will be before you start searching for a property.

How Banks Calculate Your Bond Affordability

South African Banks usually check the below factors to calculate the home loan amount you qualify for:

- Gross income

- Net income

- Total expenses

- Interest rate

- Number of years

According to Private Property, your affordability is based on around 30% of your gross monthly income and on your disposable income. A bond affordability calculator does not guarantee that you will be given a home loan, you still need to apply for a home loan with a bank.

You can use the below Home Loan Bond Calculators to see how much each bank may offer you:

- Bond Calculator FNB

- Bond Calculator ABSA

- Bond Calculator NEDBANK

- Bond Calculator STANDARD BANK

- Bond Calculator SA HOMELOANDS

- Bond Calculator FNB

- Bond Calculator Property 24

- Bond Calculator OOABA

Example Of Bond Repayment Calculator

For example, John wants to buy a property in Johannesburg for the purchase price of R85 000. John puts deposit amount of R80 000, with an interest rate of 7.25% for 20 years. According to the Bond Repayment Calculator, the monthly repayment John will pay is R6 086 after the bank grants him a loan value of R770 000. Total interest will be R690 640 and the total repayment will be R1 460 640.

https://youtu.be/wiETbob87sM?t=1

Image Courtesy: fineloans.co.za