Hot Emerging Market

South Africa has a diverse economic state – a destination of regional manufacturing hub and industrial country. It is home to natural resources and simultaneously enjoys the recognition of multinational companies.

It has garnered wide economic benefits through investment in stock trading and has encouraged private capital flow. The reason behind its booming success is due to the following facts:

It involves well-established macroeconomic environments, adequate high-income levels, a boost in domestic Savings_ the main investment equities market and an overall increase in the quality and quantity of investment. These have led to a surge in South Africa’s Stock Trading.

The economy has shown a vital contribution to gross domestic product (GDP) that is dominated by:

- Manufacturing sector

- Finance, Real estate and Business services sectors

An increase in regional integration promotes cost-efficiency and improves cash flow and price discovery.

It is a result of:

- harmonized regulation and trading laws

- accounting standards

- Automation

- currency convertibility

- a liberalized trade regime

According to reports, leading FSCA regulated CFD investors have reported a high growth ratio of 100% in their total CFD trading volume, active users & revenue in Africa in 2020. The trading growth involves diverse stock commodities.

Setting an Advancement in Technology:

Driven by technology-related dominance and possessing the largest country weight within the MSCI Emerging Market Index (MSCI EMI)_China is certainly the world’s largest consumer of commodities. This means JSE has stronger connections with China due to:

The high combined weighting of Resources Companies and Naspers/Prosus, whose sale value lies in the Science and Technology platform investment.

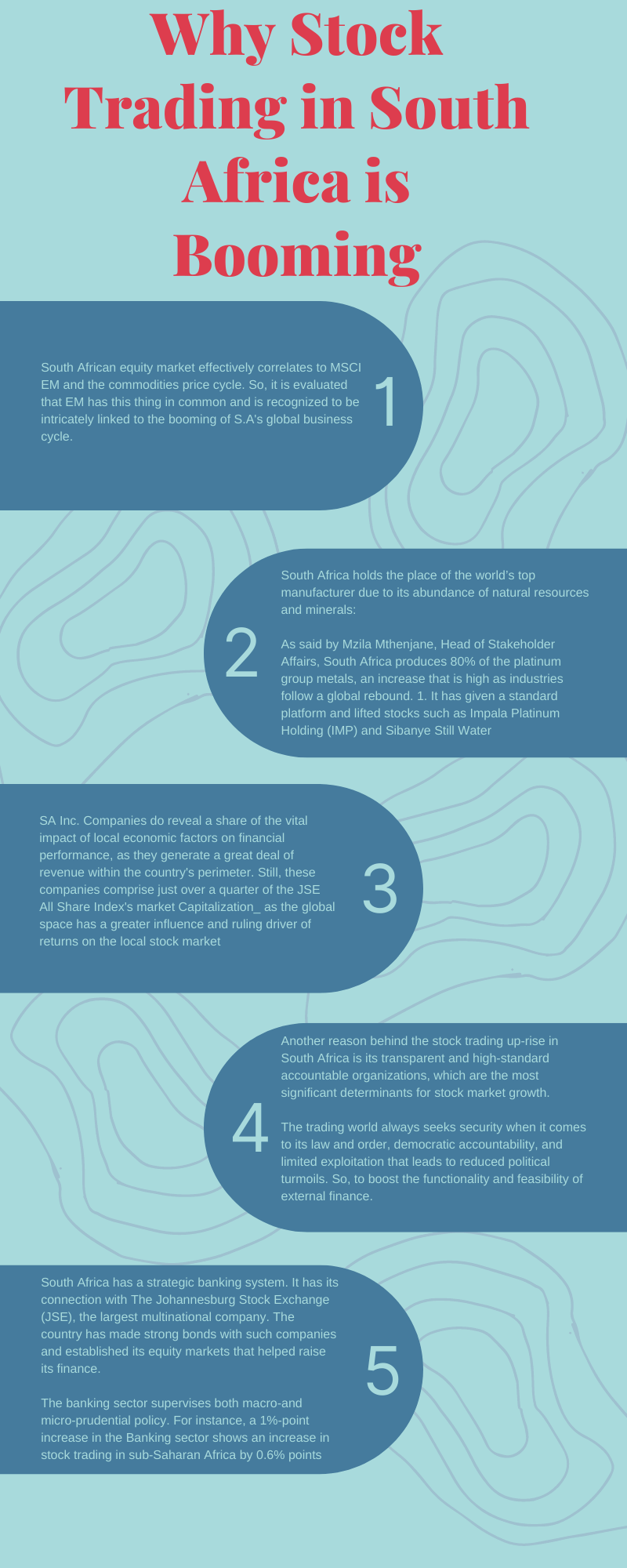

Accordingly, it is foreseeable that the South African equity market effectively correlates to MSCI EM and the commodities price cycle. So, it is evaluated that EM has this thing in common and is recognized to be intricately linked to the booming of S.A’s global business cycle.

Notable Diverse Economy State:

South Africa holds the place of the world’s top manufacturer due to its abundance of natural resources and minerals:

- Platinum

- Rhodium

- Chrome

- Manganese

- Vanadium and many other base metals

As said by Mzila Mthenjane, Head of Stakeholder Affairs, South Africa produces 80% of the platinum group metals, an increase that is high as industries follow a global rebound. It has given a standard platform and lifted stocks such as Impala Platinum Holding (IMP) and Sibanye Still Water (SSW).

Another major asset for a broker’s confidence is Mining. It is the major source of foreign exchange and jobs.

Multi-Sector Environment:

The local companies and their involvement with (Johannesburg Stock Exchange)JSE in South Africa’s Stock trading have encouraged an expanded growth on an international level. This multinational company barely collects revenue from investors.

It is the global consolidation activity that reinforced stock trading growth, as the brokers were in favor of diversifying their revenue sources. Also, South Africa’s large domestic frugal favored by exchange control limits on offshore financing.

On the other hand, SA Inc. Companies do reveal a share of the vital impact of local economic factors on financial performance, as they generate a great deal of revenue within the country’s perimeter. Still, these companies comprise just over a quarter of the JSE All Share Index’s market Capitalization_ as the global space has a greater influence and ruling driver of returns on the local stock market.

Progressive Constitution and Trading Laws:

Another reason behind the stock trading up-rise in South Africa is its transparent and high-standard accountable organizations, which are the most significant determinants for stock market growth.

The trading world always seeks security when it comes to its law and order, democratic accountability, and limited exploitation that leads to reduced political turmoils. So, to boost the functionality and feasibility of external finance.

Moreover, competent shareholder protection of brokers has made it possible to create an upsurge in stock trading. For, the investors are confident enough not to fear expropriation. Also, the broadcast of ownership in such markets adds liquidity to the market.

Developed Financial Services and Banking Sectors:

South Africa has a strategic banking system. It has its connection with The Johannesburg Stock Exchange (JSE), the largest multinational company. The country has made strong bonds with such companies and established its equity markets that helped raise its finance.

The banking sector supervises both macro-and micro-prudential policy. For instance, a 1%-point increase in the Banking sector shows an increase in stock trading in sub-Saharan Africa by 0.6% points.

Premium Infrastructure and Logistics:

South Africa has dominated in its advanced information and communication technology (ICT). Providing its people with the most sophisticated infrastructure and logistic operators and making the country an attraction for investment.

The government is looking forward to implementing a large infrastructure development program. For instance, The Presidential Infrastructure Coordination Commission (PICC) acclaims 18 strategic infrastructure projects (SIPs) to aid stock trading growth and service delivery all over South Africa.

Also, South Africa being a member of BRICS, has strong ties with the leading market traders like China and India. Thus, S.A is set to work on its global supply chain and allow exporters to reach international markets without any hindrance.

This strong infrastructure plays a better role in demutualization_ that induces a better corporate governance system and opens up stock trading rights to allow the public to invest in exchange.

The involvement of institutional brokers creates a strong impact on stock trading and they aid in greater transparency and market integrity.

Young Retail Traders:

It is the young traders who turned to online investing as a new income source. A lifetime opportunity! That has been unlocked due to the wide availability of social media and electronic communication and trading system has proliferated worldwide.

If you live in South Africa and are looking forward to stock trading from different exchanges across the world, all it requires is a sign-up using metatrader4 or any other suitable app of your concern.

This one click-away trading strategy has reduced all types of impediments and led to a doorway of revenue among the millennials.

Image Courtesy: Pixabay.com