What is RE5 Qualification? The RE5 certificate is awarded to all representatives who offer financial services to clients and individuals with an interest to learn about the insurance and finance sector. You don’t just receive re5 qualification, you are required to write the re5 exam. The goal of this article is to discuss the purpose of the re 5 examination, certificate, cost and how to prepare for the re5 exam.

ALSO READ: FinTech Disruptors Set to Shake Up South African Financial Services

What is the RE5 exam?

The Re5 exam is an examination that is written by all representatives including those employed or mandated by a Financial Service Provider (FSP), who offer a financial service to individuals or companies in South Africa. People rendering clerical, administrative, legal, accounting, technical or other service in a subsidiary level are excluded from the RE examinations.

If you offer financial services in a subordinate position which does not need judgment or does not steer to a particular transaction regarding a financial product in response to general enquiries are not required to write the re5 examination.

Learners who fail the Financial Advisory and Intermediary Services Act (FAIS-RE5) are supposed to rewrite the RE exam until they pass.

Why I Must Write the re5 Exam?

As a individual working in the insurance and finance sector or planning to work in this industry, you should study the FAIS-RE5 and write the re5 exam because the Financial Advisory and Intermediary Services (FAIS) Act governs and guides how an FSP should conduct business activities and everyday relations with its clients. As long as you provide intermediary services or give advice to clients, you are regulated by the FAIS Act. All FSPs must comply with the Act.

FAIS Act requires that only qualified and competent individuals offer services and give advice to customers who need financial advice. An untrained person of a brokerage is not allowed to give any financial advice, hence the requirement that an advisor is FAIS accredited. To work in the insurance and finance sector, you are required to have a FAIS accreditation.

How to pass the RE5 exam

There are many re5 exam online learning management systems to help you prepare for the examination. These online courses are designed to help you prepare for the re5 examination. You can expect to come across slideshows, reading material, games and quizzes. The Financial Sector Conduct Authority (FSCA) also provides the Preparation Guide. The RE5 study material will help you understand various aspects of the exam.

To pass the RE5 exam, you must get at least 65%, which is 33 correct questions out of 50. If you fail the exam, you will not be awarded the re5 qualification.

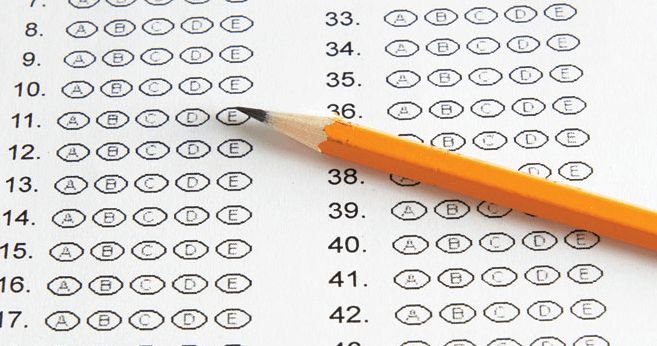

What is the format of the exam?

The exam is a closed book exam. It consists of multiple-choice questions. Each question has four options and you must choose the correct answer.

The RE 5 exam has 50 questions and the duration for the test is 2 hours. The pass mark is 66% as mentioned above.

The exams are completed in paper format using a pencil. Answers must be selected by colouring the circles. Students are advised to not tick or mark the answers with a cross.

Where Can I Study the Re5 Course?

You can study the re 5 course through online courses by registering with trusted websites. Alternatively, you can attend workshops in institutions that offer regulatory exams courses. You can study through Moonstone Business School of Excellence (MBSE), an approved education and training provider. The MBSE was established in 2015 after the acquisition of PSG Academy by the Moonstone group.

Integrity Academy institution also offers the RE 5 workshops for the Regulatory Exams. These workshops usually take up two days.

RE5 exam cost

The FSCA regulates and charge the cost of the RE5 examination in South Africa. To sit for one exam, you are required to pay an amount of R 1226, also in the case of a re-write. Please note that extra costs such as registration fee, printed study guides etc will incur if you are attending the Re 5 workshops.

Documents needed to register for the RE5 exams

You must have the following documents for you to register for the exam:

- Valid ID or Passport Number

- FSP Number

- Personal, contact and professional details

- Date of birth

The re5 Exam dates and venue for 2020

Due to the outbreak of Covid-19 in the country, exam dates have been revised. Visit the Moonstone website to check the updated dates and venues.

Glossary of Terms

- FSB – Financial Services Board

- RE – Regulatory Examination

- FAIS – Financial Advisory and Intermediary Services

- FSP – Financial Service Provider

- RE5 – First Level Regulatory Examination

- FSCA – Financial Sector Conduct Authority

Image Courtesy: learninsurance.co.za