Fasta Loans South Africa is a South African financial technology company that provides short-term loans to individuals. Fasta Loans is a registered credit provider and is accredited by the National Credit Regulator. This means that the company is subject to strict regulations and oversight. In this article, we will discuss the pros and cons of Fasta Loans, as well as some tips for using them responsibly. We will also provide a step-by-step guide on how to apply for a Fasta Loan.

Who Is Fasta Loans South Africa?

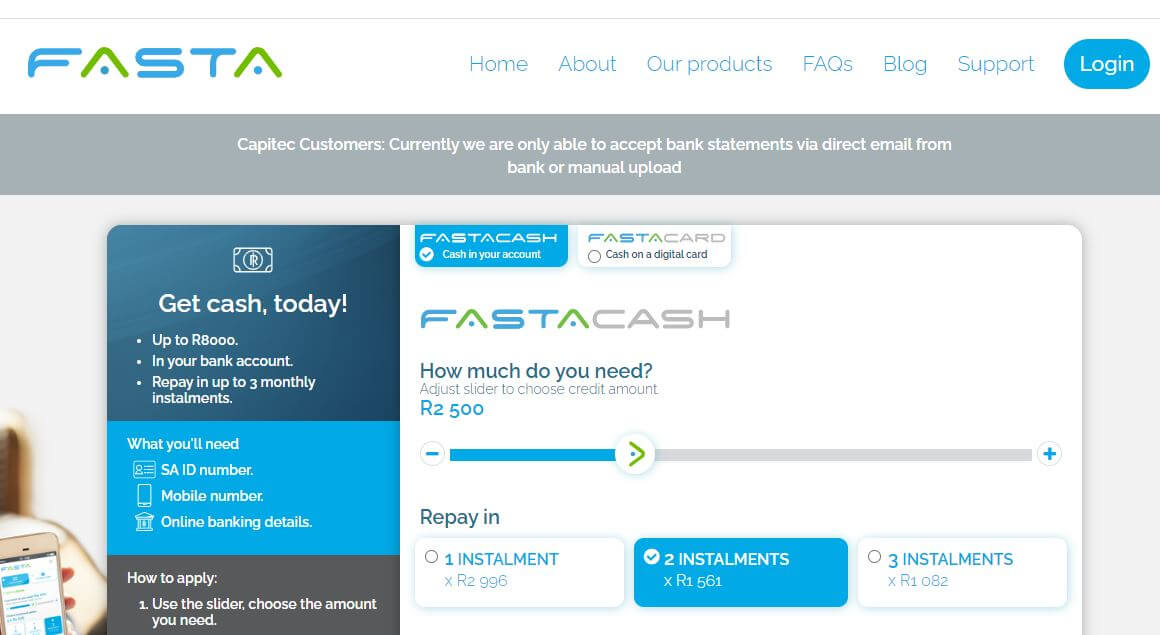

Fasta Loans South Africa is an online lender that offers short-term loans to South Africans. The company was founded in 2019 and is headquartered in Cape Town. Fasta Loans offers loans from R800 to R8000, with repayment terms of 3 or 4 months. The company’s interest rates start at 18% per annum.

Fasta Loans is a subsidiary of Knickle Holdings, a financial services company that also owns the LoanMe brand. Knickle Holdings is regulated by the Financial Services Conduct Authority (FSCA).

To apply for a loan from Fasta Loans, you must be a South African citizen or permanent resident, have a valid South African ID number, and be at least 18 years old. You must also have a monthly income of at least R6,000.

The application process for a Fasta Loans is entirely online. You can apply on the company’s website or through its mobile app. The company aims to approve or decline your application within minutes.

If your application is approved, the funds will be deposited into your bank account within 24 hours.

Fasta Loans is a registered credit provider and is subject to the National Credit Act. This means that the company is required to assess your ability to repay the loan before approving your application.

If you are considering applying for a loan from Fasta Loans, it is important to compare the interest rates and terms of other lenders before making a decision. You should also be aware of the risks associated with short-term loans, such as the high interest rates and the potential for default.

What Do I Need to Apply for Fasta Loans?

To apply for a loan from Fasta Loans South Africa, you will need to provide the following information:

- You must be above 18 years of age

- Your South African ID number

- Your date of birth

- Your contact details (email address and mobile number)

- Your bank account details

- Your monthly income

You will also need to provide a copy of your ID document and proof of income.

The exact documents you need to provide may vary depending on your circumstances. You can find more information about the required documentation on the Fasta Loans website.

Once you have submitted your application, Fasta Loans will assess your eligibility and will let you know whether your application has been approved or declined within minutes.

If your application is approved, the funds will be deposited into your bank account within 24 hours.

It is important to note that Fasta Loans is a registered credit provider and is subject to the National Credit Act. This means that the company is required to assess your ability to repay the loan before approving your application.

If you are considering applying for a loan from Fasta Loans, it is important to compare the interest rates and terms of other lenders before making a decision. You should also be aware of the risks associated with short-term loans, such as the high interest rates and the potential for default.

Here are some other things to keep in mind when applying for a loan from Fasta Loans:

- The maximum loan amount you can borrow is R8,000.

- The repayment period is either 3 or 4 months.

- The interest rate starts at 18% per annum.

- There are no hidden fees.

If you are struggling to repay your loan, you can contact Fasta Loans to discuss your options. The company may be able to offer you a repayment plan that fits your budget.

How to Apply For Fasta Loans In South Africa?

There are two ways of applying for Fasta Loans South Africa. For FastaCard and Fasta Cash, you need to register an online profile. Here are the steps on how to apply for Fasta Loans in South Africa for FASTACash or FASTACard:

- Go to the Fasta Loans website or download the mobile app.

- Click on the “Apply Now” button.

- Enter your ID number (your South African ID number is your username) on the ‘Get Started’ page.

- Enter your personal details if you are a new customer and create a profile

- For existing customers, you will be prompted for your password.

- Follow the online application process.

- The application process is entirely self-service.

For FASTACheckout, Select FASTACheckout as your payment option on one of our participating retailer’s website and follow the easy step-by-step online application without leaving the retailer’s website.

Pros And Cons

Here are some of the pros and cons of Fasta Loans South Africa:

Pros:

- Quick and easy application process

- Funds deposited into your bank account within 24 hours

- Competitive interest rates

- No hidden fees

Cons:

- High interest rates

- Short repayment terms

- Potential for default

If you are looking for a short-term loan, Fasta Loans South Africa may be a good option for you. However, it is important to compare the interest rates and terms of other lenders before making a decision.

FAQs

Here are some Fasta Loans FAQs:

How much can I borrow from Fasta Loans?

You can borrow up to R8,000 from Fasta Loans.

What are the repayment terms for Fasta Loans?

The repayment terms for Fasta Loans are either 3 or 4 months.

What is the interest rate for Fasta Loans?

The interest rate for Fasta Loans starts at 18% per annum.

Are there any hidden fees with Fasta Loans?

There are no hidden fees with Fasta Loans.

How long does it take to get a loan from Fasta Loans?

Fasta Loans aims to approve or decline your application within minutes. If your application is approved, the funds will be deposited into your bank account within 24 hours.

How do I repay my Fasta Loans?

You can repay your Fasta Loans by debit order, credit card, or bank transfer.

What if I can’t afford to repay my Fasta Loans?

If you are struggling to repay your Fasta Loans, you can contact the company to discuss your options. The company may be able to offer you a repayment plan that fits your budget.

How can I contact Fasta Loans?

You can contact Fasta Loans by phone, email, or live chat. The company’s contact details are available on its website.

Conclusion

Fasta Loans is a South African financial technology company that provides short-term loans to individuals. The company was founded in 2017 and is headquartered in Johannesburg. Fasta Loans offers loans of up to R10,000, with repayment terms of 1, 2, or 3 months. The interest rate on Fasta Loans is 22.4% per annum. To qualify for a Fasta Loan, you must be a South African citizen or permanent resident, aged 18 years or older, with a valid South African ID document, a bank account, and a minimum monthly income of R3,000.

Image Courtesy: https://www.fasta.co.za/