How do I apply for Capfin Loan via SMS in South Africa? Capfin Loan is a South African company that offers loans to individuals who need financial assistance. One of the convenient ways to apply for a Capfin loan is through SMS. Apply for a Capfin loan online from the safety of your home or SMS your SA ID number to 33005. This method of application can be particularly helpful for those who do not have easy access to the internet or prefer not to apply online. In this article, we will guide you through the steps to apply for a Capfin loan via SMS in South Africa.

ALSO READ: FinChoice Login South Africa: How to Access FinChoice Loan Account

How Do I Apply for Capfin Loan via SMS?

Applying for a Capfin loan via SMS is a quick and easy process that can be done from the comfort of your own home or on the go. Capfin is a leading South African financial services provider that offers personal loans of up to R50,000 with flexible repayment terms. If you need access to quick cash for unexpected expenses or emergencies, applying for a Capfin loan via SMS may be a good option for you.

Here’s how to apply for a Capfin loan via SMS in South Africa:

- Step 1: SMS your SA ID number to 33005

- Step 2: Follow the prompts

- Step 3: Standard SMS rates apply

What Do I Need to Apply For Capfin Loans?

To apply for Capfin loans via SMS, you will need a few things:

- South African ID: You need to be a South African citizen with a valid ID.

- Mobile phone: You need to have a valid cellphone number that is able to send SMS messages.

- Bank account: You need to have an active bank account in your name where the loan can be deposited.

- Bank Statements: Your 3 latest payslips or 3 latest bank statements

- Good credit score: Having a good credit score will increase your chances of getting approved for a loan.

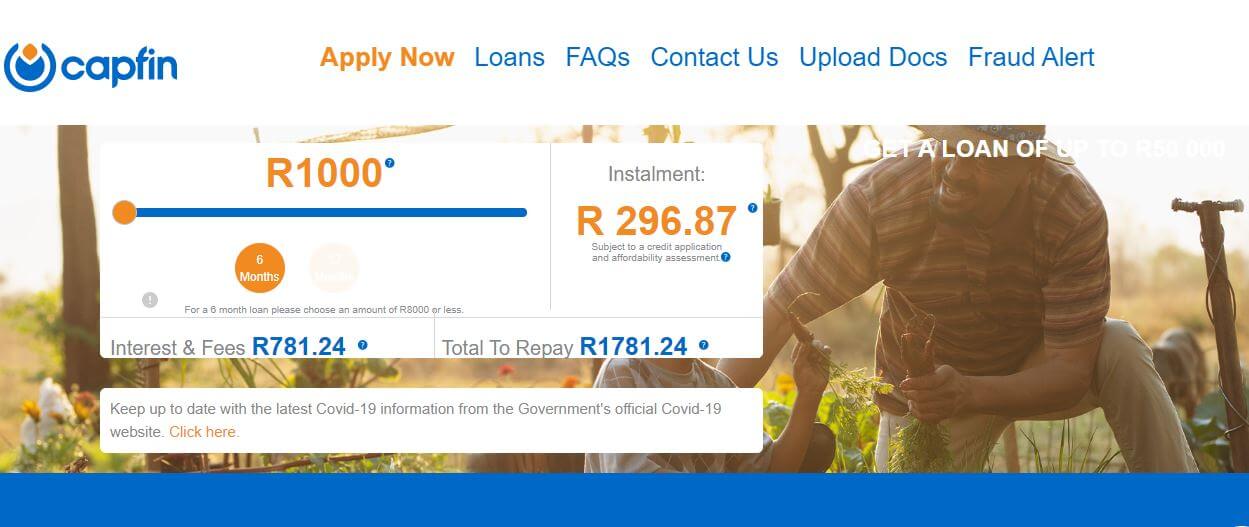

How Much Will it Cost To Pay Back My Capfin Loan?

The cost of paying back your Capfin loan will depend on the amount you borrowed, the interest rate, and the loan term. Capfin offers loans with a fixed interest rate of up to 28% per annum, and the repayment term ranges from 1 to 12 months. To determine the total cost of your loan, you can use Capfin’s loan calculator available on their website or contact their customer service for assistance. It is important to note that missing loan repayments or defaulting on your loan can result in additional fees and negatively impact your credit score.

| Repayment Term | 6 Months | 12 Months |

| Loan Amount | R4 000.00 | R4 000.00 |

| Maximum Interest Rate | 5.0% pm | 28.25% pa |

| Initiation Fee | R535.00 | R535.00 |

| Maximum Monthly Service Fee | R69.00 | R69.00 |

| Maximum Monthly Instalment | R947.00 | R504.00 |

| Maximum Loan Repayment | R5 684.00 | R6 045.00 |

What Is Capfin Loans?

Capfin Loans is a South African financial service provider that offers unsecured loans to individuals. The company provides personal loans ranging from R1,000 to R50,000 with flexible repayment terms of up to 24 months. Capfin Loans has become a popular option for South Africans who need quick access to funds for unexpected expenses or personal projects. The application process is straightforward and can be done online or via SMS, with funds being deposited into the applicant’s bank account within 24 hours upon approval. Capfin Loans is known for its affordable interest rates and transparent fee structure, making it a reputable and reliable option for those in need of financial assistance.

FAQs

Here are some frequently asked questions about Capfin loans in South Africa:

What is the maximum loan amount I can apply for with Capfin?

Capfin offers loans up to R50,000.

Can I apply for a Capfin loan if I am blacklisted?

Capfin does not specifically mention blacklisting as a disqualification for a loan. However, they will do a credit check to assess your ability to repay the loan.

How long does it take to get approved for a Capfin loan?

Capfin claims that their loan approval process is quick, and you can receive a response within minutes of applying.

How do I repay my Capfin loan?

You can repay your Capfin loan through a debit order or by making a direct deposit into their bank account.

Can I settle my Capfin loan early?

Yes, you can settle your Capfin loan early. They do not charge any penalties for early settlements.

What happens if I miss a payment on my Capfin loan?

If you miss a payment, Capfin will charge you a penalty fee, and the missed payment will affect your credit score. It is best to contact Capfin as soon as possible to discuss your options.

Can I apply for a Capfin loan online?

Yes, you can apply for a Capfin loan online through their website.

Conclusion

In conclusion, applying for a Capfin loan via SMS in South Africa is a simple and convenient process that can provide you with the financial assistance you need. To apply, SMS your SA ID number to 33005. You need to have a South African ID, a bank account, and a regular income. The cost of paying back a Capfin loan will depend on the amount borrowed, the interest rate, and the repayment period. As with any loan, it’s important to carefully consider your financial situation and make sure you can afford the repayments before applying. With its flexible repayment options and quick approval process, Capfin loans can be a viable option for those in need of short-term financial assistance.

Image Courtesy: https://www.capfin.co.za/