Boodle Loans is a reputable online lending platform in South Africa, offering quick and convenient access to short-term loans. With Boodle, individuals can easily apply for loans through their user-friendly online application process, which typically takes under 10 minutes to complete. Whether you need funds for unexpected expenses, emergencies, or personal needs, Boodle provides a seamless borrowing experience. One of the standout features of Boodle Loans is their fast payout time. If you choose their fully automated online process and accept the loan quote, you can receive the funds within 10 minutes. Even if you opt for the manual route, you can still expect to have the cash in your account within 2 hours. Boodle prioritizes efficiency and aims to provide quick solutions to your financial needs. Visit the Boodle website to explore their loan options and experience a straightforward borrowing process. In this article, you will learn how to apply for Boodle Loans South Africa.

ALSO READ: How Do I know If My Capfin Loan Is Approved

What Are Boodle Loans?

Boodle Loans is a reputable South African online lending platform that offers short-term loans to individuals who are in need of quick financial assistance. Boodle aims to provide a convenient and efficient borrowing experience, allowing customers to access funds for unexpected expenses, emergencies, or personal needs.

Boodle Loans stands out for its user-friendly online application process, which can be completed in a few simple steps. The platform offers transparent terms and competitive interest rates, giving borrowers clarity and peace of mind. Loan amounts vary based on individual eligibility, and repayment terms are typically short, ranging from a few days to a few months.

How Do I Apply For Boodle Loans?

To apply for a Boodle Loan, potential borrowers need to meet certain requirements, such as being a South African citizen or permanent resident, having a valid bank account, and demonstrating a regular income. Once approved, funds are usually disbursed quickly, often within hours, directly to the borrower’s bank account.

Repayment of Boodle Loans is typically done through automatic debit orders or scheduled repayments, making it convenient for borrowers to meet their obligations. Boodle encourages responsible borrowing and advises customers to only borrow what they can afford to repay.

Follow the below steps to apply for Boodle Loans in South Africa:

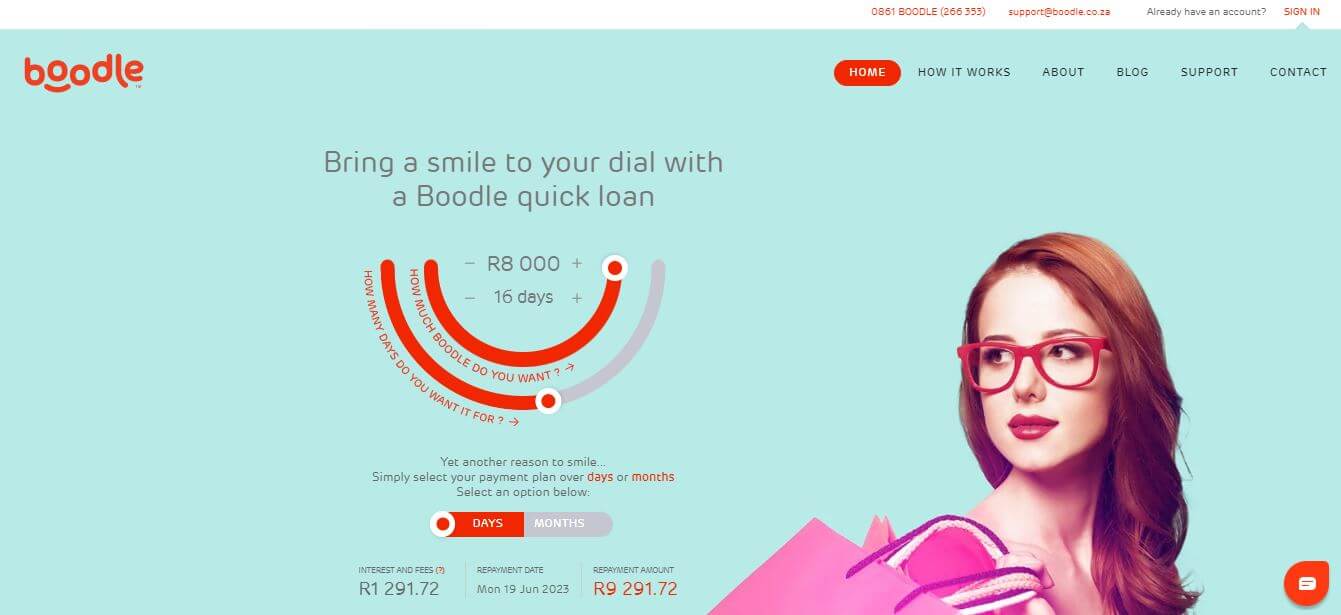

- Visit Boodle Loan website at www.boodle.co.za

- Create an account

- Select your desired amount

- Complete an online application form

- Wait for quick credit checks and loan offer

- Get your Boodle loan

With Boodle Loans, you can enjoy a quick and hassle-free application process that can be completed online in under 10 minutes. The simplicity of the application makes it even faster if you have all your required information readily available before you start.

If you opt for Boodle’s fully automated online process and accept your loan quote, you can expect to receive the funds within just 10 minutes. This ensures that you can access the cash you need promptly for your financial needs.

Alternatively, if you prefer a manual route, the process may take a bit longer, but rest assured that you will still receive your loan amount within 2 hours. Boodle understands the importance of swift access to funds, and they strive to provide a speedy turnaround time to meet your urgent requirements.

It’s worth noting that the specific timeframes mentioned are based on Boodle’s typical processing times, and actual disbursement may vary depending on factors such as bank processing times and individual circumstances.

Overall, Boodle Loans offers a convenient and efficient borrowing experience, ensuring that you can get the cash you need quickly and easily. For further information and to start your application, visit the Boodle website or contact their customer service for assistance.

Watch the Below Boodle Loan Video

Image Courtesy: www.boodle.co.za