uFiling South Africa is a secure and convenient way to file your income tax return electronically. It is a free service offered by the South African Revenue Service (SARS).

To use uFiling, you will need a valid SARS taxpayer number and a registered email address. You will also need to create a SARS eFiling account. Once you have created an account, you can log in to uFiling and start filing your return.

What Is uFiling?

Ufiling is an electronic filing system for income tax returns and other tax-related documents. It was launched by the South African Revenue Service (SARS) in 2014 as part of its efforts to modernize its tax administration system.

Ufiling South Africa is a secure and convenient way to file your income tax return. It allows you to file your return online, without having to download and install any software. You can also use Ufiling South Africa to file your return on behalf of your spouse or dependants.

To use Ufiling South Africa, you must have a valid SARS taxpayer number and a registered email address. You will also need to create a SARS eFiling account. Once you have created an account, you can log in to Ufiling South Africa and start filing your return.

Ufiling South Africa is available in English, Afrikaans, and isiXhosa. It is also available on a variety of devices, including computers, smartphones, and tablets.

Ufiling South Africa Benefits

Here are some of the benefits of using Ufiling South Africa:

- It is a secure and convenient way to file your income tax return.

- It is easy to use, even if you are not familiar with computers.

- It is available in English, Afrikaans, and isiXhosa.

- It is available on a variety of devices, including computers, smartphones, and tablets.

- It is free to use.

How Does Ufiling Work In South Africa?

To use Ufiling, you must have a valid SARS taxpayer number and a registered email address. You will also need to create a SARS eFiling account. Once you have created an account, you can log in to Ufiling and start filing your return.

Here is a step-by-step guide on how to use Ufiling to file your income tax return in South Africa:

- Go to the SARS website and log in to your eFiling account.

- Click on the “Ufiling” tab.

- Select the tax year for which you want to file your return.

- Click on the “Start Filing” button.

- Follow the on-screen instructions to complete your return.

- Once you have completed your return, review it carefully and make sure that all of the information is correct.

- Click on the “Submit” button to submit your return.

- You will receive a confirmation message from SARS once your return has been submitted successfully.

Ufiling is available in English, Afrikaans, and isiXhosa. It is also available on a variety of devices, including computers, smartphones, and tablets.

How to Create uFiling Account?

To create a uFiling account in South Africa, you will need to have a valid SARS taxpayer number and a registered email address. You can create an account by following these steps:

- Go to the SARS website and click on the “eFiling” tab.

- Click on the “Register for eFiling” button.

- Enter your SARS taxpayer number and your email address.

- Create a password for your account.

- Answer the security questions and click on the “Register” button.

- You will receive an email from SARS with a link to activate your account.

- Click on the link in the email to activate your account.

- Once your account is activated, you can log in to uFiling and start filing your income tax return.

If you have any problems creating a uFiling account, you can contact SARS for assistance.

Here are some additional tips for creating a uFiling account:

- Make sure that you use a valid SARS taxpayer number and a registered email address.

- Create a strong password for your account. Your password should be at least 8 characters long and should include a mix of upper and lowercase letters, numbers, and symbols.

- Do not share your uFiling login details with anyone.

- Keep your uFiling account information up to date. If you change your email address or phone number, be sure to update your uFiling account information as well.

Once you have created a uFiling account, you can use it to file your income tax return, submit tax-related documents, and view your tax history.

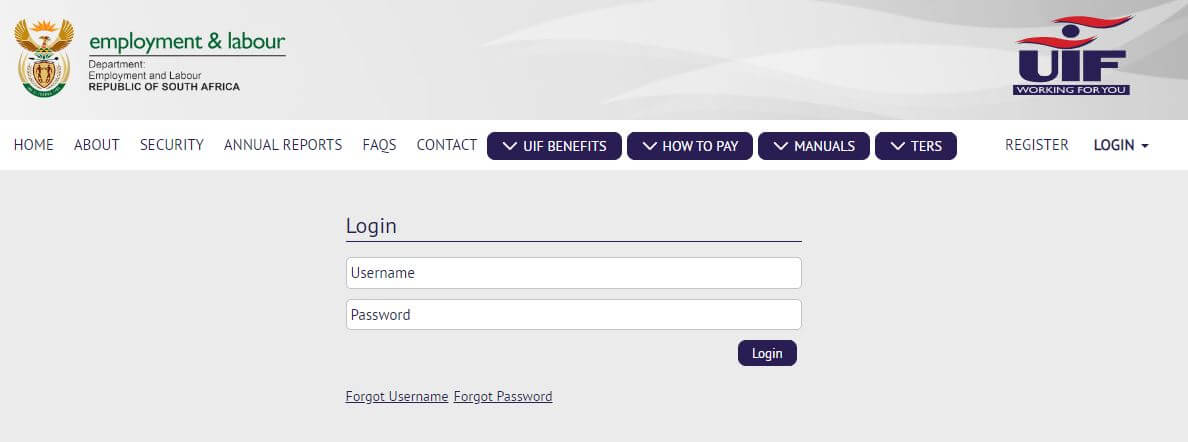

How To Login To uFiling?

To login to uFiling in South Africa, you will need your SARS taxpayer number and the password that you created when you created your uFiling account.

To login:

- Go to the SARS website and click on the “eFiling” tab.

- Click on the “Login to eFiling” button.

- Enter your SARS taxpayer number and your password.

- Click on the “Login” button.

If you have forgotten your password, you can click on the “Forgot Password?” link and follow the instructions to reset your password.

Once you have logged in to uFiling, you can access all of the features of the system, including filing your income tax return, submitting tax-related documents, and viewing your tax history.

Here are some additional tips for logging in to uFiling:

- Make sure that you are using the correct SARS taxpayer number and password.

- If you are logging in from a public computer, be sure to log out when you are finished.

- Do not share your uFiling login details with anyone.

If you have any problems logging in to uFiling, you can contact SARS for assistance.

uFiling FAQs

What is uFiling?

uFiling is a secure and convenient way to file your income tax return electronically in South Africa. It is a free service offered by the South African Revenue Service (SARS).

Who can use uFiling?

Any South African taxpayer can use uFiling to file their income tax return. You do not need to have any accounting or tax experience to use uFiling.

How do I create a uFiling account?

To create a uFiling account, you will need a valid SARS taxpayer number and a registered email address. You can create an account on the SARS website.

How do I log in to uFiling?

To log in to uFiling, you will need your SARS taxpayer number and the password that you created when you created your uFiling account. You can log in on the SARS website.

How do I file my income tax return using uFiling?

To file your income tax return using uFiling, follow these steps:

- Log in to your uFiling account.

- Select the tax year for which you want to file your return.

- Click on the “Start Filing” button.

- Follow the on-screen instructions to complete your return.

- Once you have completed your return, review it carefully and make sure that all of the information is correct.

- Click on the “Submit” button to submit your return.

- You will receive a confirmation message from SARS once your return has been submitted successfully.

What are the benefits of using uFiling?

There are many benefits to using uFiling, including:

- It is secure and convenient.

- It is easy to use, even if you are not familiar with computers.

- It is available in English, Afrikaans, and isiXhosa.

- It is available on a variety of devices, including computers, smartphones, and tablets.

- It is free to use.

What can I do if I need help with uFiling?

If you need help with uFiling, you can contact SARS for assistance. You can also find helpful information on the SARS website.

Can I file my income tax return on behalf of someone else using uFiling?

Yes, you can file the income tax return of your spouse or dependent on their behalf using uFiling. To do this, you will need to have their SARS taxpayer number and their authorization.

Can I use uFiling to file my income tax return if I have a business?

Yes, you can use uFiling to file your income tax return if you have a business. uFiling supports a variety of business income types, including sole proprietorship, partnership, and company income.

Can I use uFiling to file my income tax return if I am a foreign taxpayer?

Yes, foreign taxpayers can use uFiling to file their income tax returns in South Africa. However, you will need to have a South African tax number and you will need to meet certain residency requirements.

Conclusion

uFiling South Africa is a secure and convenient way to file your income tax return electronically. It is a free service offered by the South African Revenue Service (SARS).

uFiling is easy to use, even if you are not familiar with computers. It is also available in English, Afrikaans, and isiXhosa, and on a variety of devices, including computers, smartphones, and tablets.

Image Courtesy: https://ufiling.labour.gov.za/uif/login