What Is UIFCC In South Africa? The Unemployment Insurance Fund Contribution Collection (UIFCC) is a South African tax that is paid by both employers and employees. The money collected from UIFCC is used to fund the Unemployment Insurance Fund (UIF), which provides financial assistance to workers who have lost their jobs or are unable to work due to illness, maternity, or adoption.

What Is UIFCC In South Africa?

UIFCC stands for Unemployment Insurance Fund Contribution Collection. It is a tax that is paid by both employers and employees in South Africa. The money collected from UIFCC is used to fund the Unemployment Insurance Fund (UIF), which provides financial assistance to workers who have lost their jobs or are unable to work due to illness, maternity, or adoption.

The UIFCC rate is calculated as a percentage of the employee’s earnings. The employer pays 2% of the employee’s earnings towards UIFCC, and the employee pays 1% of their earnings. The maximum UIFCC contribution per employee is R292.50 per month.

UIFCC is payable on all earnings, including wages, salaries, bonuses, overtime pay, and commissions. However, there are some exceptions, such as earnings from self-employment, earnings from part-time work that is less than 24 hours per week, and earnings from casual employment.

Employers are required to register their employees with the UIF and to pay UIFCC on their behalf. Employers can pay UIFCC online, through their bank, or through a third-party payment service provider.

Employees who are registered with the UIF and who have paid UIFCC for at least six months are eligible to claim benefits from the UIF. The benefits that are available include unemployment benefits, illness benefits, maternity benefits, adoption benefits, and death benefits.

To claim benefits from the UIF, employees must register as a work seeker and submit a claim form. The claim form can be submitted online, through a UIF office, or through a labour centre.

The UIF plays an important role in the South African social safety net by providing financial assistance to workers who have lost their jobs or are unable to work. UIFCC is essential to funding the UIF and ensuring that it can continue to provide these important benefits.

How Does The UIFCC Work In South Africa?

The Unemployment Insurance Fund Contribution Collection (UIFCC) works in South Africa by collecting contributions from both employers and employees. These contributions are used to fund the Unemployment Insurance Fund (UIF), which provides financial assistance to workers who have lost their jobs or are unable to work due to illness, maternity, or adoption.

Employers are required to register their employees with the UIF and to pay UIFCC on their behalf. The UIFCC rate is calculated as a percentage of the employee’s earnings, and the employer pays 2% of the employee’s earnings towards UIFCC, and the employee pays 1% of their earnings. The maximum UIFCC contribution per employee is R292.50 per month.

Employers can pay UIFCC online, through their bank, or through a third-party payment service provider.

Employees who are registered with the UIF and who have paid UIFCC for at least six months are eligible to claim benefits from the UIF. The benefits that are available include unemployment benefits, illness benefits, maternity benefits, adoption benefits, and death benefits.

To claim benefits from the UIF, employees must register as a work seeker and submit a claim form. The claim form can be submitted online, through a UIF office, or through a labour centre.

The UIFCC system works by collecting contributions from all employers and employees in South Africa. This ensures that there is a pool of money available to help workers who have lost their jobs or are unable to work.

The UIFCC system is administered by the Department of Employment and Labour. The department is responsible for registering employers and employees with the UIF, collecting UIFCC contributions, and paying benefits to eligible workers.

The UIFCC system is an important part of the South African social safety net. It provides financial assistance to workers who are unemployed or unable to work, which helps to reduce poverty and improve the lives of workers and their families.

UIFCC FAQs

Here are some frequently asked questions about UIFCC:

What is UIFCC?

UIFCC stands for Unemployment Insurance Fund Contribution Collection. It is a tax that is paid by both employers and employees in South Africa. The money collected from UIFCC is used to fund the Unemployment Insurance Fund (UIF), which provides financial assistance to workers who have lost their jobs or are unable to work due to illness, maternity, or adoption.

Who pays UIFCC?

Both employers and employees are required to pay UIFCC. The employer pays 2% of the employee’s earnings towards UIFCC, and the employee pays 1% of their earnings.

What is the maximum UIFCC contribution per month?

The maximum UIFCC contribution per employee is R292.50 per month.

How do employers pay UIFCC?

Employers can pay UIFCC online, through their bank, or through a third-party payment service provider.

Who is eligible to claim benefits from the UIF?

Employees who are registered with the UIF and who have paid UIFCC for at least six months are eligible to claim benefits from the UIF.

What benefits are available from the UIF?

The benefits that are available from the UIF include unemployment benefits, illness benefits, maternity benefits, adoption benefits, and death benefits.

How do I claim benefits from the UIF?

To claim benefits from the UIF, you must register as a work seeker and submit a claim form. The claim form can be submitted online, through a UIF office, or through a labour centre.

What if I have any questions about UIFCC?

If you have any questions about UIFCC, you can contact the Department of Employment and Labour. The department is responsible for administering the UIFCC system and providing information to employers and employees.

Conclusion

The Unemployment Insurance Fund Contribution Collection (UIFCC) is an important part of the South African social safety net. It provides financial assistance to workers who have lost their jobs or are unable to work, which helps to reduce poverty and improve the lives of workers and their families.

Employers are required to register their employees with the UIF and to pay UIFCC on their behalf. Employees who are registered with the UIF and who have paid UIFCC for at least six months are eligible to claim benefits from the UIF. The benefits that are available include unemployment benefits, illness benefits, maternity benefits, adoption benefits, and death benefits.

If you have any questions about UIFCC, you can contact the Department of Employment and Labour. The department is responsible for administering the UIFCC system and providing information to employers and employees.

Please note that this is just a general overview of UIFCC. There are a number of complex rules and regulations that apply to the system. If you have any specific questions about UIFCC, you should consult with a qualified professional.

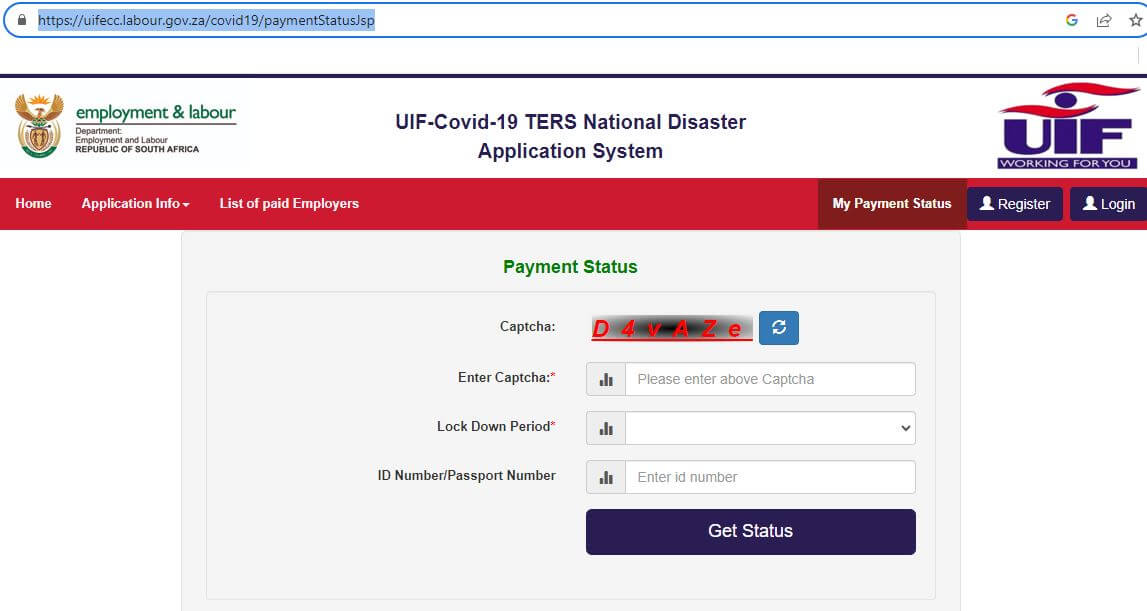

Image Courtesy: https://uifecc.labour.gov.za/covid19/paymentStatusJsp