Fasta Loans has emerged as a favored option among South African residents seeking swift access to funds. Offering a combination of flexible repayment terms, low-interest rates, and various credit options, it has gained popularity. However, the enticing offers often raise skepticism among potential borrowers.

To address any uncertainties and inquiries surrounding these loans, this comprehensive Fasta Loans review aims to provide clarity. By carefully examining the details presented here, readers can make informed decisions regarding their financial needs.

In This Article

ToggleAbout Fasta Loans

Fasta Loan is a prominent financial lending institution operating in the South African market, specializing in short-term loan programs. Established in 2012 under the umbrella of Knickle Holding Private Ltd., it has become a well-known name in the industry.

Fasta Loan is recognized for its swift and convenient loan approval process, often providing funds on the same day. This efficiency has earned it the nickname “Access to Credit Instantly,” reflecting its commitment to providing fast and accessible financial solutions to its customers.

- Address: Spaces, Dock Road Junction, Cnr Stanley & Dock Road, V&A Waterfront, Cape Town, 8001.

- Email: [email protected]

- Contact: No Official Number

- Official Website: Click here

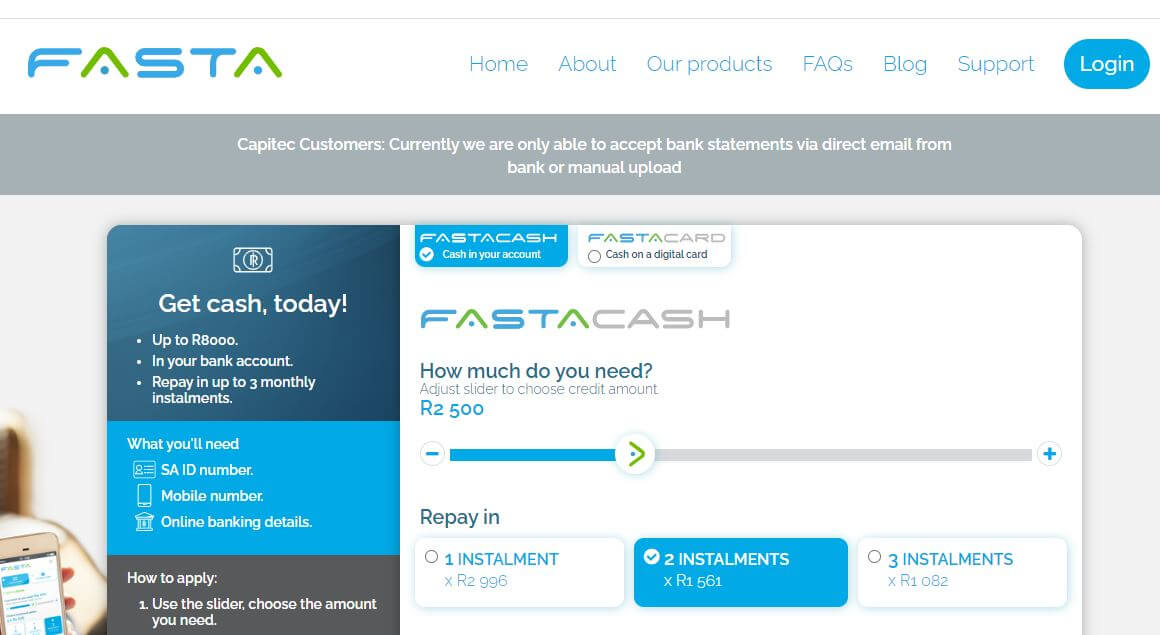

Fasta Loans offers a range of loans from R800 to R8000, featuring a flexible repayment period spanning six months. All of their loans are paperless, self-service, and available online. This means that applicants have the convenience of managing the entire process, from application to approval and accessing funds, with minimal guidance required.

One notable advantage of Fasta Loans is that their loan products are designed and distributed in compliance with the regulations of the National Credit Act (NCA). As a result, loan applications undergo thorough evaluation, scoring, and approval processes. This approach helps to mitigate the risk of fraudulent activities within the lending process, providing borrowers with added security and peace of mind.

Types Of Fasta Credit Offerings In South Africa

Fasta offers a diverse range of credit offerings designed to provide beneficiaries with quick access to funds directly into their bank accounts. Here are the three most popular credit offerings:

Fasta Cash

This facility allows beneficiaries to receive the loan cash amount instantly in their bank accounts. Whether applying for an R800 or R8000 loan, the cash is deposited directly into their bank account, providing flexibility to use it for any purpose, anywhere.

Fasta Card

The Fasta Card offering enables beneficiaries to utilize the loan money virtually with a Mastercard. By activating this offer on the card, users can spend money just like they would with a credit or debit card, offering convenience and flexibility in transactions.

Fasta Checkout

This credit offer is tailored for online shopping from specific retailers. When users have selected all desired items in their cart, they can opt for the Fasta checkout service to complete the payment process seamlessly, enhancing the convenience of online shopping transactions.

Borrowing Amount

Fasta offers loans ranging from R2000 to R8000, providing borrowers with flexibility in accessing funds. These loans are regulated by the National Credit Act (NCA), ensuring compliance and minimizing the risk of fraudulent activities.

Repayment Terms

Fasta loans offer flexible repayment periods, typically spanning three to six months. Borrowers have the flexibility to tailor their repayment schedule according to their financial feasibility. In case of insufficient funds for repayment in one term, a small penalty may be incurred in the following term. Fasta provides a loan calculator to assist borrowers in customizing their repayment plans, helping them determine interest rates, initiation fees, monthly fees, and more.

Interest Rate

Fasta loans are popular due to their competitive interest rates, which are regulated by the NCA and typically start at 3%. The actual interest rate is personalized for each candidate based on their credit score. Upon application, Fasta provides approval, allowing borrowers to access funds upon acceptance.

Additional Charges

In addition to interest rates and repayment fees, borrowers are required to pay an administration fee of R69. There is also a one-time initiation fee based on the loan amount applied for.

Quick and Convenient Loans

Fasta loans are known for their speed and convenience, facilitated by a large network of third-party entities including customer support centers, dealers, debt collectors, and agencies across the country. This network enables same-day approval and distribution of funds through online banking, enhancing the borrower experience.

Fasta Loan has established partnerships with various merchants and retailers to enhance the accessibility and usability of its services. Some of the notable merchant partners include SnapScan, Zapper, and Mastercard commercial banks. Additionally, Fasta has collaborated with numerous retailer partners such as Digicape, BU Co, SPCC, Prime Persian, Queen Park, and more.

Through these partnerships, borrowers can take advantage of Fasta’s Checkout and Fasta Card services. The Fasta Checkout service enables seamless online shopping transactions with select retailer partners, allowing borrowers to complete purchases conveniently. Similarly, the Fasta Card service empowers users to utilize loan funds virtually with a Mastercard, offering flexibility and ease of use akin to traditional credit or debit cards.

These partnerships broaden the scope of Fasta’s offerings, providing borrowers with additional avenues to access and utilize loan funds according to their needs and preferences.

Requirements for Fasta Loans South Africa

To apply for Fasta Loans, applicants must meet the following requirements:

- South African Citizenship: Applicants must be South African citizens with a verified national ID card number.

- Age Requirement: Applicants must be 18 years old or older at the time of application.

- Income Verification: For loan amounts over R5000, applicants may need to provide their latest salary slips and bank statements.

- Credit Check: Fasta Loans conducts a credit check for each applicant during the application process.

- Proof of Residence: Applicants are required to submit proof of residence.

- Employment Letter: Applicants should provide an employment letter to verify their source of income.

- Cell Phone: Applicants need to have a cell phone to monitor the application process.

- Internet Access: Since the application process is online, applicants need a device and a stable internet connection.

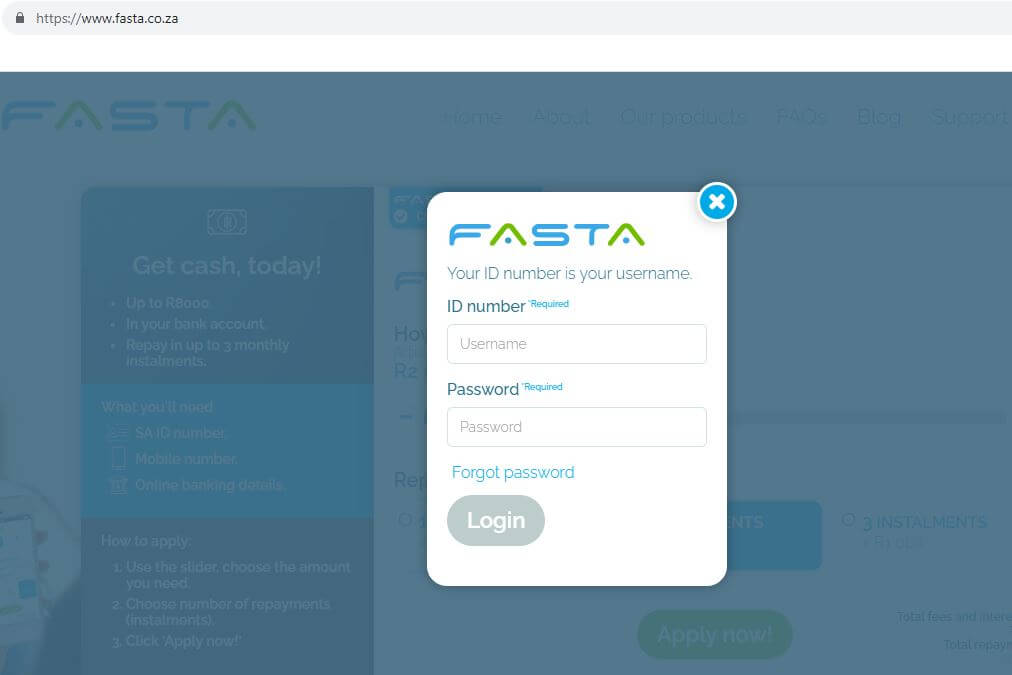

Application Process: The application process for Fasta Loans is straightforward and conducted entirely online through the official portal. Applicants need to fill in personal details and submit the required documents. Customer support is available 24/7 via phone and email to assist with any queries or challenges during the application process.

Pros and Cons of Fasta Loans:

Pros:

- Convenient, fast, and straightforward application process taking less than five minutes.

- Faster approval rate compared to competitors.

- Multiple credit offering options available.

- Flexible repayment period with a loan calculator for customized plans.

Cons:

- Mandatory requirement for a credit protection plan, limiting options for borrowers.

- Limited to short-term loans; no large cash loans available for long-term plans.

FAQs:

- Who is Fasta loan best for? Fasta Loans are suitable for individuals employed in South Africa who need short-term loans to cover additional expenses.

- Are Fasta loans reliable and safe? Yes, Fasta Loans operate under the regulation of the National Credit Act (NCA), ensuring safety and reliability in the lending process.

- How much loan does Fasta offer? Fasta offers short-term loans ranging from R800 to R8000, with a repayment period of up to six months and a 3% interest rate.

Conclusion

Fasta Loans is a reputable financial lending institution in South Africa, offering small-scale, short-term loans to residents. Potential applicants should consider consulting customer support before making a decision to ensure a clear understanding of the terms and conditions.

Image Courtesy: Fasta Loans