Sunshine Loans is a short-term loan lender that offers loans of up to R4,000 to South African residents. The company is 100% online, so you can apply for a loan from anywhere, 24/7. To qualify for a Sunshine Loans loan, you must be a South African citizen or permanent resident, be at least 18 years old, and have a valid South African ID. You must also have a bank account in South Africa and a regular income. Sunshine Loans is a registered credit provider with the National Credit Regulator (NCR). This means that the company is subject to strict lending regulations. You can check the NCR website to verify that Sunshine Loans is a legitimate lender.

If you are looking for a quick and convenient way to borrow money, Sunshine Loans may be a good option for you. However, it is important to compare interest rates and fees before you apply for any loan. In this article, you will learn how to apply for Sunshine Loans in South Africa.

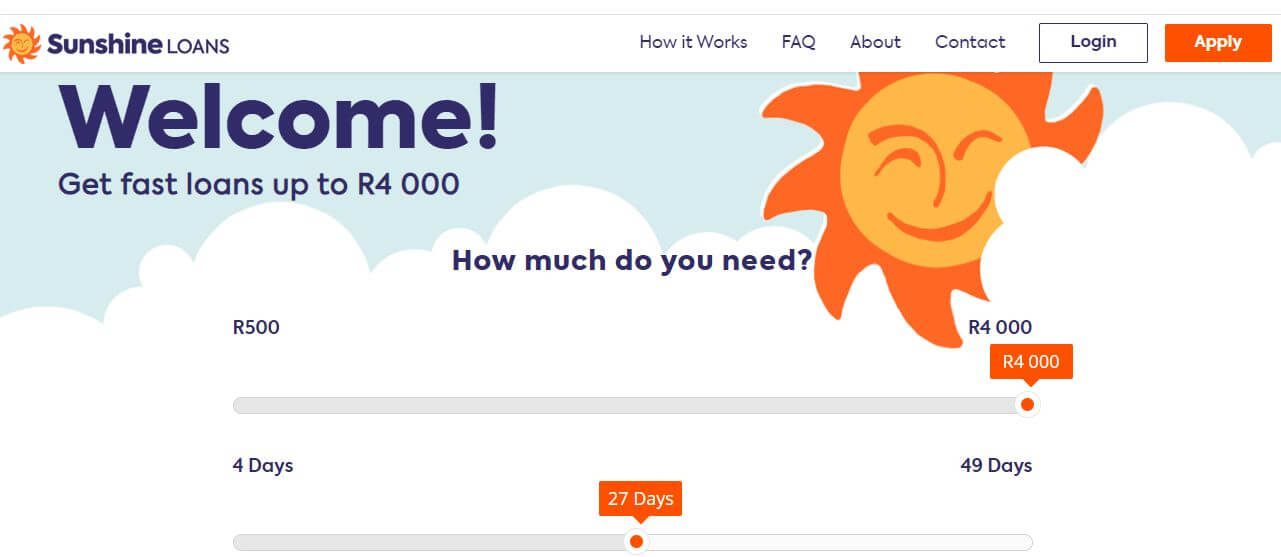

What Is Sunshine Loans?

Sunshine Loans is a South African short-term loan provider that offers loans of up to R4,000 over a period of up to 49 days. They are a 100% online lender, so you can apply for a loan and get approved in minutes.

To qualify for a Sunshine Loans, you must be a South African citizen or permanent resident, be at least 18 years old, and have a valid South African ID and bank account. You must also have a good credit history. The interest rate on Sunshine Loans is 22.1% per annum. This is a high interest rate, so it is important to make sure that you can afford the repayments before you apply for a loan.

If you are considering applying for a Sunshine Loans, it is important to compare their rates and terms to other lenders before you make a decision. You should also be aware of the risks involved in taking out a short-term loan.

Requirements To Apply For Sunshine Loans

Here are the requirements to apply for Sunshine Loans in South Africa:

- You must be a South African citizen or permanent resident.

- You must be at least 18 years old.

- You must have a valid South African ID and bank account.

- You must have a good credit history.

- You must be employed and have a regular income.

- You must be able to afford the monthly repayments.

The following documents are required to apply for Sunshine Loans:

- Valid South African ID

- Proof of residence no older than 3 months

- 1 month’s payslip

- 3 months’ most recent bank statements

If you are self-employed, you will need to provide additional documentation, such as your business registration certificate and tax returns.

Sunshine Loans may also require you to undergo a credit check. This is to assess your ability to repay the loan.

If you meet all of the requirements, you can apply for a Sunshine Loans online. The application process is quick and easy. You can get approved and have the money in your bank account within 24 hours.

Here are some additional things to keep in mind when applying for a Sunshine Loans:

- Make sure you understand the terms and conditions of the loan before you apply.

- Be aware of the total amount you will have to repay, including interest and fees.

- Make sure you can afford the repayments before you take out the loan.

- If you are struggling to repay the loan, contact Sunshine Loans as soon as possible.

How To Apply For Sunshine Loans In South Africa?

Here are the steps on how to apply for Sunshine Loans in South Africa:

- Go to the Sunshine Loans website and click on the “Apply Now” button.

- Click on “New Customer” or ” Existing Customer”

- Select how much you want to borrow

- Choose the loan purpose

- Fill out the online application form. You will need to provide your personal information, create password

- Upload your South African ID and proof of residence.

- Download your bank statements for the past 3 months.

- Submit your application.

Sunshine Loans will typically process and approve applications in less than 60 minutes during business hours. If your application is approved, the money will be deposited into your bank account within 24 hours.

How Does Sunshine Loan Work In South Africa?

Step 1: Online application

Apply using Sunshine Loans online loan calculator and application form. Sunshine Loans South Africa only ask you for essential information that will enable them to assess your application.

Step 2: Quick approval process

They will verify your information and outline the terms of your loan, which you can e-sign online. It takes just minutes to complete

Step 3: Cash in your account

Once you’ve e-signed your loan offer, they’ll carry out a few final checks. Once approved, Sunshine Loans will send your cash typical by the next business day.

Sunshine Loan Pros And Cons

Here are some of the pros and cons of Sunshine Loans:

Pros:

- Quick and easy application process

- Up to R4,000 loan amount

- 49-day loan term

- No hidden fees

- Regulated by the National Credit Regulator

Cons:

- High interest rate

- Short loan term

- May impact your credit score

If you are considering taking out a Sunshine Loans, it is important to weigh the pros and cons carefully to make sure that it is the right decision for you.

Here are some additional things to keep in mind when considering a Sunshine Loans:

- Make sure you understand the terms and conditions of the loan before you apply.

- Be aware of the total amount you will have to repay, including interest and fees.

- Make sure you can afford the repayments before you take out the loan.

- If you are struggling to repay the loan, contact Sunshine Loans as soon as possible.

FAQs

Here are some FAQs about Sunshine Loans South Africa:

What are the eligibility requirements for a Sunshine Loans loan?

To qualify for a Sunshine Loans loan, you must:

- Be a South African citizen or permanent resident

- Be at least 18 years old

- Have a valid South African ID

- Have a bank account in South Africa

- Have a regular income

How much can I borrow from Sunshine Loans?

Sunshine Loans offers loans of up to R4,000.

What are the interest rates and fees for Sunshine Loans?

The interest rate for Sunshine Loans is 22.7% per annum. There is also a flat processing fee of R195.

What is the repayment period for Sunshine Loans?

The repayment period for Sunshine Loans is up to 49 days.

How do I apply for a Sunshine Loans loan?

You can apply for a Sunshine Loans loan online. Simply fill out the application form and provide some basic information about yourself and your income.

How long does it take to get approved for a Sunshine Loans loan?

Sunshine Loans aims to approve loan applications within 60 minutes during business hours.

What happens if I miss a repayment on my Sunshine Loans loan?

If you miss a repayment on your Sunshine Loans loan, you will be charged a late payment fee of R50. You may also be asked to pay additional interest.

How can I contact Sunshine Loans?

You can contact Sunshine Loans by phone, or email. The contact details are available on the Sunshine Loans website.

Conclusion

Sunshine Loans is a legitimate lender that offers quick and convenient loans to South African residents. However, it is important to compare interest rates and fees before you apply for any loan. If you are struggling to make your repayments, contact Sunshine Loans as soon as possible. They may be able to help you work out a payment plan. Ultimately, the decision of whether or not to take out a loan from Sunshine Loans is a personal one. You should weigh the pros and cons carefully before making a decision.

Image Courtesy: sunshineloans.co.za