Unifi Credit is a South African online lender that offers unsecured loans to individuals. The company was founded in 2016 and is headquartered in Stellenbosch, South Africa. Unifi Credit offers loans ranging from R2,000 to R8,000 with repayment terms of up to 6 months. The company’s lending criteria are relatively simple, and they do not require any collateral or guarantors.

Unifi Credit is a registered credit provider with the National Credit Regulator (NCR). This means that the company is subject to the NCR’s lending regulations, which protect consumers from unfair lending practices. Unifi Credit is a good option for individuals who need quick and easy access to cash. The company’s loans are relatively affordable, and the repayment terms are flexible. However, it is important to remember that any loan is a debt, and you should only borrow what you can afford to repay. Here’s everything you need to know Unifi Credit application process in South Africa.

What Is Unifi Credit?

Unifi Credit is a South African online lender that offers unsecured loans to individuals. The company was founded in 2016 and is headquartered in Stellenbosch, South Africa. Unifi Credit offers loans ranging from R2,000 to R8,000 with repayment terms of up to 6 months. The company’s lending criteria are relatively simple, and they do not require any collateral or guarantors.

Unifi.Credit is a registered credit provider with the National Credit Regulator (NCR). This means that the company is subject to the NCR’s lending regulations, which protect consumers from unfair lending practices.

To apply for a loan with Unifi Credit, you can do so online or by phone. The company’s application process is quick and easy, and you can get a decision within minutes. If your application is approved, you will receive the funds in your bank account within 24 hours.

Unifi Credit is a good option for individuals who need quick and easy access to cash. The company’s loans are relatively affordable, and the repayment terms are flexible. However, it is important to remember that any loan is a debt, and you should only borrow what you can afford to repay.

Here are some of the pros and cons of Unifi.Credit:

Pros:

- Quick and easy application process

- Funds available within 24 hours

- Affordable loans

- Flexible repayment terms

- Registered credit provider with the NCR

Cons:

- Interest rates can be high

- Loans are unsecured, so there is no collateral

- Late payments can result in penalties

Overall, Unifi Credit is a reputable online lender that offers a variety of loans to individuals. However, it is important to compare interest rates and repayment terms before you apply for a loan.

How to Apply For Unifi Credit Loan Online In South Africa?

Here are the steps on how to apply for a Unifi Credit loan online in South Africa:

- Go to the Unifi.Credit website

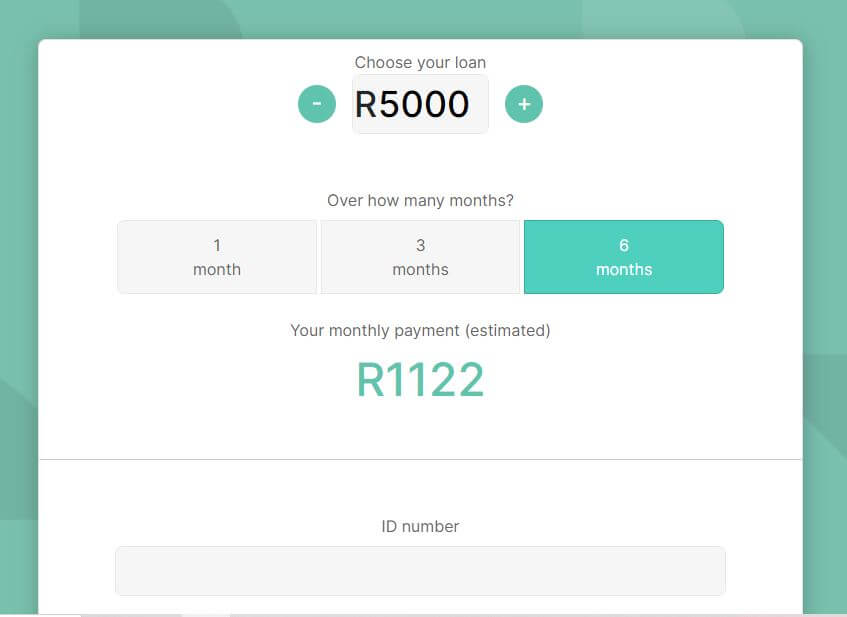

- Enter the amount you want and select the number of months

- Enter your ID number and click on the “Apply” button.

- Enter your personal information, including your name, contact details, and employment information.

- Provide your bank account details so that the funds can be deposited directly into your account.

- Upload proof of income, such as a recent payslip or bank statement.

- Read and agree to the terms and conditions of the loan.

- Submit your application.

Unifi Credit will review your application and will provide you with a decision within minutes. If your application is approved, you will receive the funds in your bank account within 24 hours.

Here are some of the documents you will need to apply for a Unifi Credit loan:

- A valid South African ID number

- A recent payslip or bank statement

- Proof of address

You can also apply for a Unifi Credit loan by phone. The phone number is (021) 11 00 600

Here are some of the things to keep in mind when applying for a Unifi Credit loan:

- You must be a South African citizen or permanent resident.

- You must be at least 18 years old.

- You must have a valid South African ID number.

- You must have a bank account in South Africa.

- You must have a steady income.

Unifi Credit’s lending criteria are relatively simple, and they do not require any collateral or guarantors. However, the company does have a maximum loan amount of R8,000.

If you are approved for a Unifi Credit loan, you will be charged interest on the amount you borrow. The interest rate will depend on your credit score and the amount of the loan.

You will also be required to make monthly repayments on your loan. The repayment amount will depend on the amount of the loan, the interest rate, and the repayment term.

It is important to remember that any loan is a debt, and you should only borrow what you can afford to repay. If you are unable to make your monthly repayments, you may be subject to penalties.

Image Courtesy: unifi.credit