Unifi Loans has emerged as a game-changer in the South African lending landscape, revolutionizing the way people access credit. With a strong commitment to technological innovation and data-driven solutions, Unifi Loans is reshaping the traditional lending experience. This forward-thinking financial institution utilizes world-class data analytics and cutting-edge technology to offer a credit product that is unlike any other in the market. By leveraging advanced algorithms and real-time data, Unifi Loans South Africa aims to provide fast, transparent, and personalized loan options to formally employed individuals. With their branches, websites, and user-friendly apps, Unifi Loans empowers South Africans with convenient access to much-needed funds. Join us as we explore how Unifi Loans is transforming the credit landscape in South Africa and enabling greater financial inclusion for all.

ALSO READ: How Do I Apply for Capfin Loan via SMS?

Who Is Unifi Loans?

Unifi Loans is a financial institution that offers fast and straightforward personal loans to formally employed individuals in Sub-Saharan Africa. They provide access to loans through various channels, including branches, websites, and mobile applications, in countries such as Zambia, South Africa, Uganda, and Kenya.

By offering their services through multiple platforms, Unifi Loans aims to make the loan application and approval process more convenient and accessible for their target market. It suggests that they prioritize simplicity and efficiency in providing financial solutions to individuals in need of personal loans.

Unifi Loans Login

It’s easy to login to your Unifi Loans account online. Follow the below steps:

- Step 1: Open your web-browser

- Step 2: Go to https://unifi.credit/za/

- Step 3: Enter your valid SA ID number and click “Let’s Go”

- Step 4: You will receive an OTP to your cellphone number registered for RICA

- Step 5: Enter the OTP and you will be logged in automatically

What You’ll Need When Applying For Unifi Loans?

- Your cellphone – Keep your phone close for verification and in case we need to update you on your application’s progress.

- A bank account – For verification and so we know where to send your money. It should be an account that was opened under your name (have your ID number linked to the account) and into which your monthly salary is paid. We currently support ABSA, FNB, Standard Bank, Capitec Bank, Nedbank and African Bank.

- Employment – You’ll need to be employed and paid monthly.

- Proof of income – Automatically fetch your bank statement from your online banking to get your loan superfast, or upload a document.

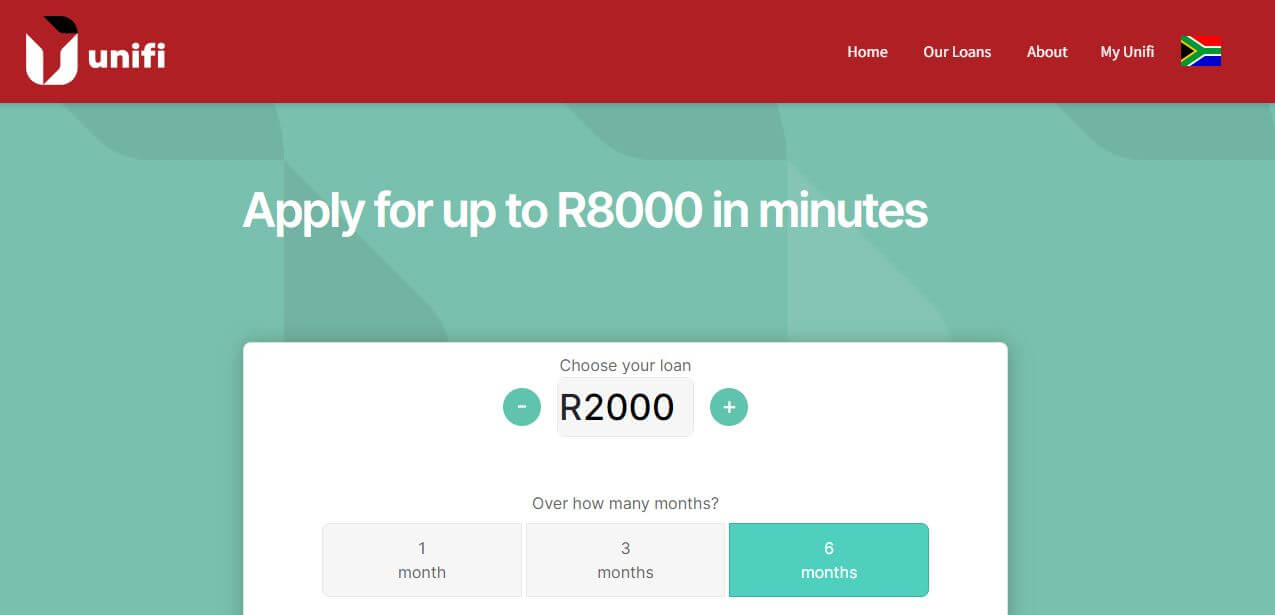

How Do I borrow Money From Unifi Loans South Africa?

- Go to Unifi Loans website at https://unifi.credit/za/

- Click on ‘My Unifi’

- Enter your ID number and choose a password.

- Complete our easy online application form.

- Attach your latest three payslips or bank statements.

- Get cash sent straight to your bank account on the same day.

Image Courtesy: unifi.credit