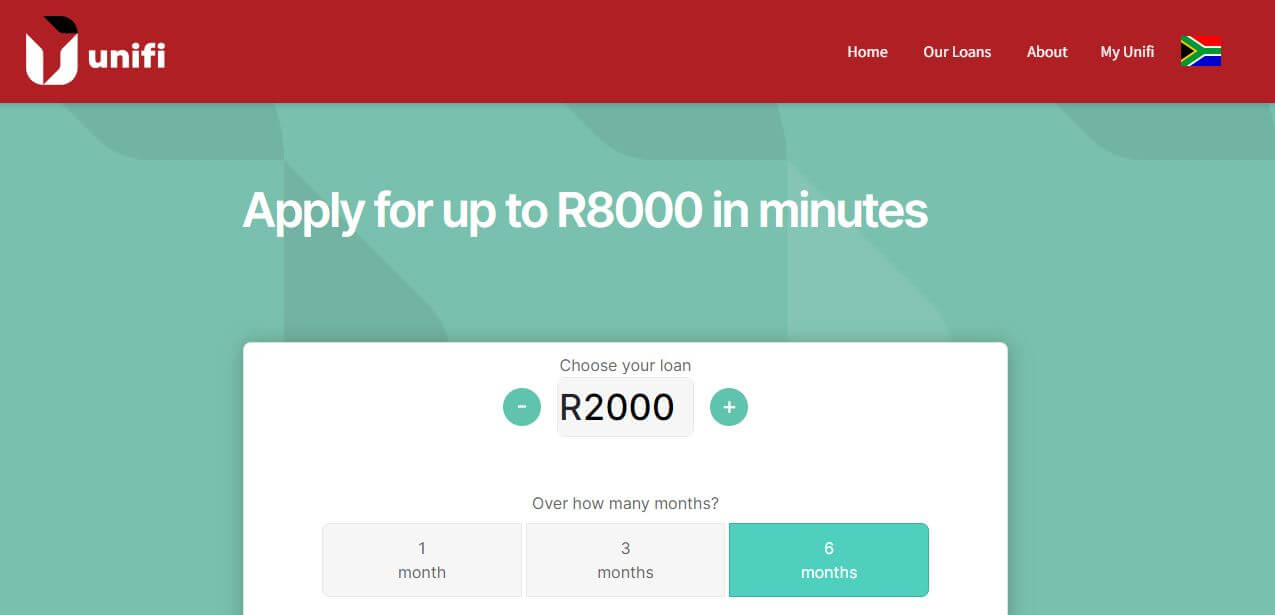

Unifi Loans is a South African online lender that offers personal loans to employed individuals. The company offers loans ranging from R2,000 to R8,000 with a repayment period of up to 6 months. The interest rate on Unifi Loans is 24.9% per annum.

The application process for a Unifi Loan is quick and easy. You can apply online in just a few minutes. All you need to do is provide your personal details, proof of income, and bank account details. If your application is approved, you will receive the funds in your bank account within 24 hours.

Unifi Loans is a registered credit provider with the National Credit Regulator (NCR). This means that the company is required to follow strict lending guidelines. Unifi Loans also offers a variety of features to protect borrowers, such as early repayment and loan protection insurance.

If you are looking for a quick and easy way to get a small loan in South Africa, then Unifi Loans may be a good option for you. However, it is important to carefully consider the terms and conditions of the loan before you apply.

What Is Unifi Loans?

Unifi Loans is a South African online lender that offers personal loans to employed individuals. The company was founded in 2018 and is headquartered in Johannesburg. Unifi Loans offers loans ranging from R2,000 to R8,000 with a repayment period of up to 6 months. The interest rate on Unifi Loans is 24.9% per annum.

The application process for a Unifi Loan is quick and easy. You can apply online in just a few minutes. All you need to do is provide your personal details, proof of income, and bank account details. If your application is approved, you will receive the funds in your bank account within 24 hours.

Here are some of the benefits of applying for a Unifi Loan:

- The application process is quick and easy.

- You can get the funds within 24 hours.

- There are no hidden fees or charges.

- The interest rate is competitive.

However, there are also some potential drawbacks to consider before applying for a Unifi Loan:

- The maximum loan amount is R8,000.

- The repayment period is up to 6 months.

- The interest rate is 24.9% per annum.

If you are looking for a quick and easy way to get a small loan in South Africa, then applying for a Unifi Loan may be a good option for you. However, it is important to carefully consider the terms and conditions of the loan before you apply.

Here are some additional things to keep in mind when considering a Unifi Loan:

- You will need to have a good credit score to be approved for a loan.

- You will need to make sure that you can afford the monthly repayments.

- You should read the terms and conditions carefully before you apply for a loan.

If you are unsure whether a Unifi Loan is right for you, you should speak to a financial advisor.

How To Apply For Unifi Loans Online In South Africa?

Here are the steps on how to apply for Unifi loans online in South Africa:

- Step 1: Open your web-browser

- Step 2: Go to https://unifi.credit/za/

- Step 3: Enter your valid SA ID number and click “Apply Now”

- Step 4: You will receive an OTP to your cellphone number registered for RICA

- Step 5: Enter the OTP and you will be logged in automatically

If your application is approved, you will receive the funds in your bank account within 24 hours.

Here are some of the requirements for applying for a Unifi loan online in South Africa:

- You must be a South African citizen or permanent resident.

- You must be at least 18 years old.

- You must have a valid ID number.

- You must have a bank account in South Africa.

- You must be employed and have a regular income.

The maximum loan amount you can apply for is R8,000. The repayment period is up to 6 months. The interest rate is 24.9% per annum.

Here are some of the benefits of applying for a Unifi loan online in South Africa:

- The application process is quick and easy.

- You can get the funds within 24 hours.

- There are no hidden fees or charges.

- The interest rate is competitive.

If you are looking for a quick and easy way to get a loan in South Africa, then applying for a Unifi loan online is a good option.

FAQs

Here are some FAQs about Unifi Loans:

- What are the requirements for applying for a Unifi Loan?

To be eligible for a Unifi Loan, you must:

- Be a South African citizen or permanent resident.

- Be at least 18 years old.

- Have a valid ID number.

- Have a bank account in South Africa.

- Be employed and have a regular income.

- What is the maximum loan amount I can apply for?

The maximum loan amount you can apply for is R8,000.

- What is the repayment period?

The repayment period for a Unifi Loan is up to 6 months.

- What is the interest rate on Unifi Loans?

The interest rate on Unifi Loans is 24.9% per annum.

- How do I apply for a Unifi Loan?

You can apply for a Unifi Loan online. Simply go to the Unifi website and click on the “Apply for a loan” button. You will need to provide your personal details, proof of income, and bank account details. If your application is approved, you will receive the funds in your bank account within 24 hours.

- What are the fees and charges associated with Unifi Loans?

There are no hidden fees or charges associated with Unifi Loans. However, you will need to pay interest on the loan amount. The interest rate is 24.9% per annum.

- What are the benefits of applying for a Unifi Loan?

The benefits of applying for a Unifi Loan include:

- The application process is quick and easy.

- You can get the funds within 24 hours.

- There are no hidden fees or charges.

- The interest rate is competitive.

- What are the drawbacks of applying for a Unifi Loan?

The drawbacks of applying for a Unifi Loan include:

- The maximum loan amount is R8,000.

- The repayment period is up to 6 months.

- The interest rate is 24.9% per annum.

- Is a Unifi Loan right for me?

Whether or not a Unifi Loan is right for you depends on your individual circumstances. If you are looking for a quick and easy way to get a small loan in South Africa, then applying for a Unifi Loan may be a good option for you. However, it is important to carefully consider the terms and conditions of the loan before you apply.

Conclusion

In conclusion, Unifi Loans is a South African online lender that offers personal loans to employed individuals. The company offers loans ranging from R2,000 to R8,000 with a repayment period of up to 6 months. The interest rate on Unifi Loans is 24.9% per annum.

The application process for a Unifi Loan is quick and easy. You can apply online in just a few minutes. All you need to do is provide your personal details, proof of income, and bank account details. If your application is approved, you will receive the funds in your bank account within 24 hours.

There are both benefits and drawbacks to consider before applying for a Unifi Loan. The benefits include the quick and easy application process, the fact that there are no hidden fees or charges, and the competitive interest rate. The drawbacks include the maximum loan amount of R8,000, the repayment period of up to 6 months, and the high interest rate.

Whether or not a Unifi Loan is right for you depends on your individual circumstances. If you are looking for a quick and easy way to get a small loan in South Africa, then applying for a Unifi Loan may be a good option for you. However, it is important to carefully consider the terms and conditions of the loan before you apply.

Image Courtesy: unifi.credit