How to reverse a transaction on FNB? This guide is designed to walk you through the process of reversing a transaction on FNB, offering insights into the steps to take, the scenarios where reversals are applicable, and the tools provided by the bank to ensure a seamless resolution.

How To Reverse A Transaction On FNB?

Reversing a transaction on FNB can be done under certain circumstances, and the process depends on the type of transaction and how long it’s been since it occurred. Here’s a breakdown of the options:

1. Incorrect EFT Payment:

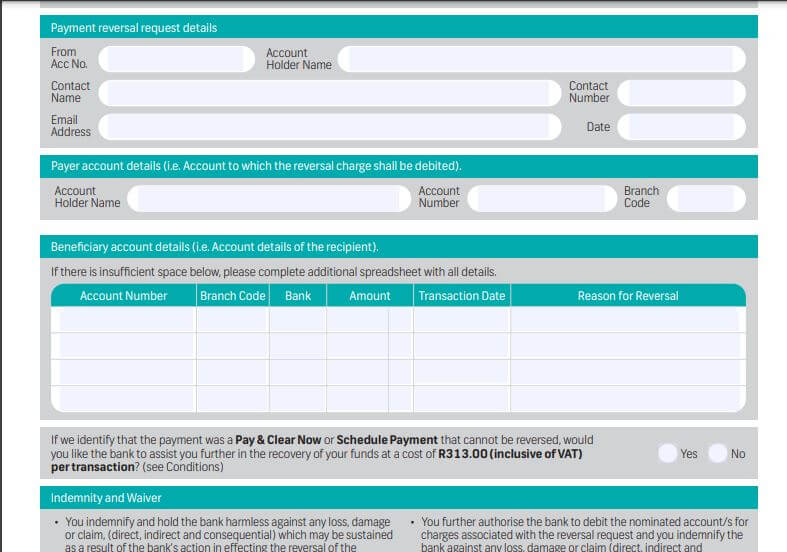

If you’ve made an incorrect EFT payment through FNB online banking or the FNB app, you can submit a Payment Reversal Request Form within 30 calendar days of the transaction. This form is available online on the FNB website (https://www.online.fnb.co.za/rhelp_0_15/OB_SA_Downloads/Downloads/Reversals/Reversal_Request_Documentation.pdf) and requires completion with details like the incorrect recipient’s account number, transaction amount, and reason for reversal. Upon submission, FNB will attempt to recover the funds from the recipient’s bank, but success depends on whether the funds have already been withdrawn. A R313 non-refundable fee applies to this service.

Follow the below steps to reverse a payment:

- Complete the Payment Reversal Request Form in full.

- This form must be completed in full and signed by the account holder/mandated representative.

- The completed form must be e-mailed to ‘[email protected]

- You will receive an automated response with a reference number for the reversal request.

2. Fraudulent Transaction:

If you suspect a fraudulent transaction on your FNB account, report it immediately to FNB’s fraud department by calling 087 575 9444. They will guide you through the reporting process and take necessary steps to secure your account and investigate the fraudulent activity. You may also need to file an affidavit at a police station to support the investigation.

3. Debit Order Dispute:

If you have an unauthorized or incorrect debit order set up on your account, you can dispute it through online banking, cellphone banking (*120*321#), or at an FNB branch. You’ll need to provide details about the debit order and reason for dispute. FNB will then contact the debit originator to try and stop the debit order or reverse it if it has already been processed.

4. Cash Withdrawal Dispute:

If you believe a cash withdrawal from your account was unauthorized or incorrect, you need to report it to FNB immediately by calling 087 575 9444. They will investigate the matter and advise you on further steps.

How To Reverse A Transaction On FNB FAQs

Q: Can I reverse any FNB transaction?

A: Unfortunately, not all transactions can be reversed. The success depends on several factors, like the type of transaction, how long ago it happened, and cooperation from the recipient’s bank (for EFTs).

Q: How do I reverse an incorrect EFT payment?

A: Act fast! Within 30 days, fill out the Payment Reversal Request Form online: Be sure to include details like the wrong account number, amount, and reason for reversal. FNB will try to recover the funds, but success isn’t guaranteed. A R313 fee applies.

Q: What if I suspect a fraudulent transaction?

A: Time is of the essence! Immediately call FNB’s fraud department at 087 575 9444. They’ll guide you through the reporting process and secure your account. You might also need to file a police affidavit.

Q: Can I dispute an unauthorized debit order?

A: Absolutely! Do it through online banking, cellphone banking (120321#), or at an FNB branch. Provide details about the debit order and why you’re disputing it. FNB will contact the originator to try and stop or reverse the payment.

Q: I think a cash withdrawal was unauthorized. What should I do?

A: Don’t delay! Call FNB’s fraud department immediately at 087 575 9444. They’ll investigate and advise you on further steps.

Q: Any tips for avoiding transaction mishaps?

A: Double-check account numbers and amounts before hitting “send.” Be cautious about online purchases and sharing your login credentials. Regularly monitor your account for suspicious activity.

Conclusion

Whether you sent a payment to the wrong planet or tackled a rogue debit order like a financial ninja, you’ve navigated the maze of FNB transaction reversals like a champ! Remember, acting fast and choosing the right method are key to reclaiming your funds. So, keep this guide handy, stay vigilant with your account, and know that a simple oops doesn’t have to mean financial doom. Now, go forth and conquer your finances with newfound confidence!

Image Courtesy: fnb.co.za