Standard Bank Instant Money is a digital wallet service that allows you to send and receive money instantly, without the need for a bank account. It is a convenient and affordable way to send money to friends and family, or to pay for goods and services online and at participating retailers. Here’s everything you need to know about the Standard Bank Instant Money South Africa.

What Is Standard Bank Instant Money?

Standard Bank Instant Money is a convenient and secure way to send and receive money without the need for a bank account. It is a mobile wallet that can be used to send and receive money, buy prepaid airtime, data, and electricity, and pay for goods and services at selected retailers.

Why Use Standard Bank Instant Money?

There are many reasons why you might want to use Standard Bank Instant Money. Here are a few of the most common reasons:

- Convenience: Standard Bank Instant Money is very convenient to use. You can send and receive money from your cellphone or at a participating retailer. This means that you can send and receive money even if you are not near a bank branch or ATM.

- Speed: Standard Bank Instant Money is very fast. The money that you send is typically received by the recipient within minutes. This is especially useful if you need to send money to someone in an emergency.

- Affordability: Standard Bank Instant Money is very affordable. There are no monthly fees for using the service. You only pay a small fee when you send or receive money.

- Accessibility: Standard Bank Instant Money is accessible to anyone with a cellphone number. This means that you can use Standard Bank Instant Money even if you do not have a bank account. This is especially useful for people who are unbanked or underbanked.

How Does The Standard Bank Instant Money Work?

Standard Bank Instant Money works by using a mobile wallet. To use Instant Money, you need to register for the service and create an Instant Money Wallet. You can register for Instant Money by dialing 120212# or by visiting a Standard Bank ATM or branch.

Once you have registered for Instant Money, you can load money into your Instant Money Wallet using a variety of methods, including:

- Standard Bank ATM

- Standard Bank App

- Standard Bank Mobile Banking

- Standard Bank Internet Banking

- Participating retailers

Once you have money in your Instant Money Wallet, you can send it to anyone with a cellphone number in South Africa. The recipient will receive an SMS message with a voucher number and PIN. They can then cash out the voucher at any Standard Bank ATM or participating retailer.

How To Send Money Using Standard Bank Instant Money?

o send money using Standard Bank Instant Money:

- Open the Standard Bank App or dial *120*212# on your cellphone.

- Select the “Send Money” option.

- Enter the recipient’s cellphone number and the amount of money you want to send.

- Confirm the transaction.

- You will receive an SMS message with a voucher number and PIN.

- Share the voucher number and PIN with the recipient.

How To Withdraw Standard Bank Instant Money?

The recipient can then cash out the voucher at any Standard Bank ATM or participating retailer by following these steps:

- Visit a Standard Bank ATM or participating retailer.

- Select the “Withdraw Cash” option.

- Enter the voucher number and PIN.

- Enter the amount of money you want to withdraw.

- Collect your cash.

Standard Bank Instant Money is a safe and convenient way to send and receive money. It is also a good option for people who do not have a bank account.

FAQs

Here are some frequently asked questions about Standard Bank Instant Money:

What is Standard Bank Instant Money?

Standard Bank Instant Money is a digital wallet service that allows you to send and receive money instantly, without the need for a bank account. You can use Instant Money to send money to anyone in South Africa, regardless of whether they have a bank account or not. The recipient can then withdraw the money from any Standard Bank ATM or participating retailer.

How do I register for Standard Bank Instant Money?

To register for Standard Bank Instant Money, you can:

- Dial *120*212# on your cellphone and follow the instructions.

- Visit the Standard Bank website or mobile app and go to the Instant Money section.

- Visit a Standard Bank branch and ask a teller to help you register.

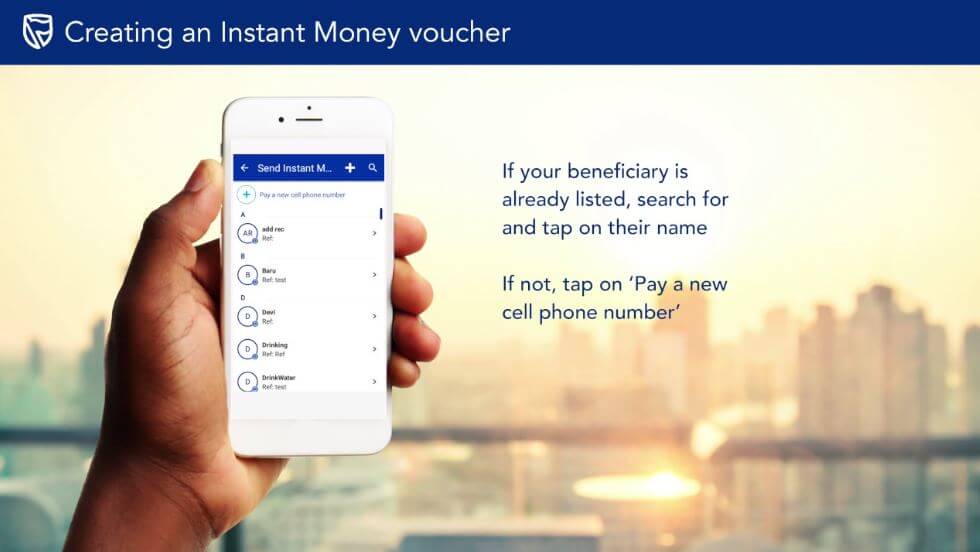

How do I send money using Standard Bank Instant Money?

To send money using Standard Bank Instant Money, you can:

- Use the Standard Bank mobile app or website.

- Dial *120*212# on your cellphone and follow the instructions.

- Visit a Standard Bank ATM.

- Visit a participating retailer.

You will need to provide the recipient’s cellphone number and name, as well as the amount of money you want to send. You will also need to create a 4-digit PIN code for the recipient.

How does the recipient receive the money?

The recipient will receive an SMS message with a voucher number and PIN code. They can then withdraw the money from any Standard Bank ATM or participating retailer by presenting the voucher number and PIN code.

What are the limits for using Standard Bank Instant Money?

You can send and receive up to R5 000 per day and R25 000 per month using Standard Bank Instant Money.

What are the fees for using Standard Bank Instant Money?

There are no monthly fees or charges to receive money using Standard Bank Instant Money. However, there is a fee of R10 to send money.

How do I contact Standard Bank Instant Money customer support?

You can contact Standard Bank Instant Money customer support by calling 0860 466 639.

Do I need a bank account to use Standard Bank Instant Money?

No, you do not need a bank account to use Standard Bank Instant Money.

Can I send money to someone outside of South Africa using Standard Bank Instant Money?

No, you cannot send money to someone outside of South Africa using Standard Bank Instant Money.

What can I do if I lose my Standard Bank Instant Money voucher number or PIN code?

You can contact Standard Bank Instant Money customer support on 0860 466 639 to retrieve your voucher number or PIN code.

What can I do if I am not able to withdraw my Standard Bank Instant Money?

If you are not able to withdraw your Standard Bank Instant Money, you can contact Standard Bank Instant Money customer support on 0860 466 639 for assistance.

Conclusion

Standard Bank Instant Money is a convenient and affordable way to send and receive money in South Africa, without the need for a bank account. It is ideal for people who need to send money to family and friends in rural areas, or for people who want to avoid the high fees associated with traditional money transfer services.

Image Courtesy: YouTube