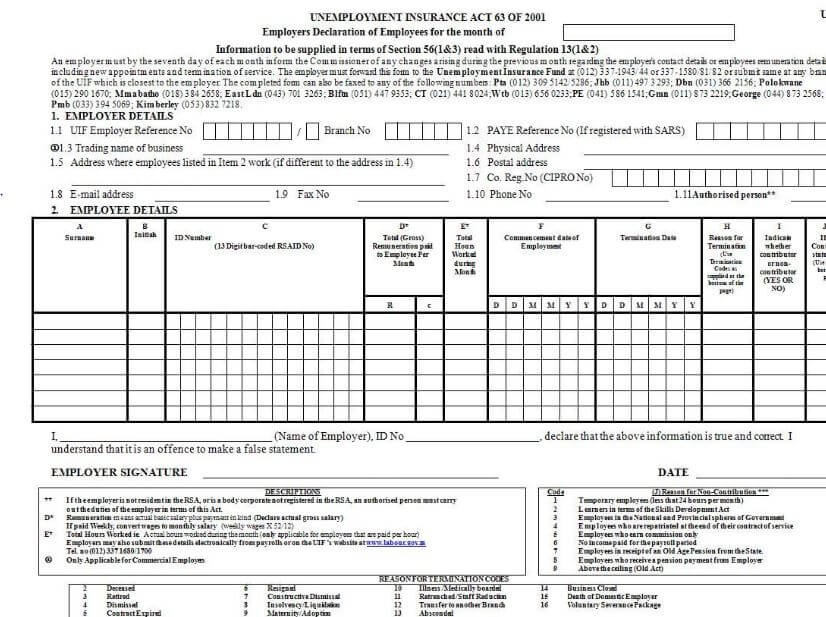

The UI19 Form in South Africa is a form that confirms the employment status and history, as well as the salary and hours worked by an employee. The UI-19 form is a Declaration of Information of Commercial Employees and Workers Employed in a Private Household required by the Unemployment Insurance Fund (UIF) in South Africa. It is used to declare an employee’s employment status, salary, and hours worked during a specific period. This information is crucial for calculating the employee’s UIF contributions and assessing their eligibility for unemployment benefits.

ALSO READ: What’s The UIF Contact Number

What Is UI19 Form In South Africa?

The UI19 form, also known as the “Declaration of Information of Commercial Employees and Workers Employed in a Private Household,” is an official document used in South Africa to record the employment history of an individual. It is primarily used by employers to provide information about their employees to the Unemployment Insurance Fund (UIF), a government-run program that provides financial assistance to eligible workers who become unemployed.

Purpose of the UI19 Form

The UI19 form serves several crucial purposes in the context of the UIF:

- Employee Record Keeping: It serves as a comprehensive record of an employee’s employment history, including their name, ID number, employment details, salary, and pay period.

- UI Contribution Calculation: It provides essential information for calculating an employee’s contributions to the UIF, which are deducted from their salary.

- Unemployment Benefit Eligibility: It plays a vital role in determining an employee’s eligibility for unemployment benefits if they become unemployed.

- Employer Compliance: It ensures that employers comply with their legal obligations to provide accurate employment information to the UIF.

When is the UI19 Form Used?

The UI19 form is typically used in the following situations:

- New Employee Registration: When an employer hires a new employee, they are required to complete and submit a UI19 form for that employee to the UIF.

- Employee Changes: If there are any changes to an employee’s employment details, such as a salary change, position change, or termination, the employer is required to update the UI19 form accordingly and submit it to the UIF.

- Unemployment Benefit Claims: When an employee files for unemployment benefits, the UI19 form serves as supporting documentation to verify their employment history and contribution records.

Obtaining and Completing the UI19 Form

The UI19 form can be obtained from the UIF website, UIF offices, or through the employer’s UIF online portal. It is a relatively straightforward form to complete, requiring basic information about the employee, their employment details, and their salary.

Significance of the UI19 Form

The UI19 form plays a significant role in the UIF system by ensuring accurate records of employment history, facilitating the calculation of UI contributions, and determining eligibility for unemployment benefits. It also ensures that employers fulfill their legal obligations to the UIF.

FAQs

Here are some frequently asked questions about the UI-19 form in South Africa:

When should I submit a UI-19 form?

Employers are required to submit UI-19 forms on a monthly basis for all their eligible employees. The deadline for submitting the form is the 7th of the following month. For example, if the payroll period is from 1st to 31st of January, the UI-19 form for that period must be submitted by 7th of February.

What are the penalties for late submission of UI-19 forms?

Employers who fail to submit UI-19 forms on time may be liable for penalties. The penalty for late submission is currently R100 for each day that the form is late, up to a maximum of R5,000 per employee.

Can I submit UI-19 forms electronically?

Yes, you can submit UI-19 forms electronically through the UIF’s online portal, ufiling.labour.gov.za. This is the quickest and most efficient way to submit the forms.

What is the difference between the paper and electronic UI-19 forms?

The paper and electronic UI-19 forms are identical in terms of the information they require. The only difference is that the electronic form can be submitted more quickly and easily than the paper form.

What if I have questions about the UI-19 form?

The UIF website has a comprehensive FAQ section that answers many common questions about the UI-19 form. You can also contact the UIF call center on 0800 010 232 for assistance.

Conclusion

The UI-19 form plays a vital role in the administration of the UIF in South Africa. It ensures that accurate and timely information is available to determine UIF contributions, assess benefit eligibility, and calculate benefit amounts. Employers play a crucial role in completing and submitting these forms accurately and promptly to maintain the integrity of the UIF system.

Image Courtesy: formfactory.co.za