SAB Zenzele Kabili and EasyEquities are two separate entities, but they are related in that EasyEquities provides a platform for investors to buy and sell shares in SAB Zenzele Kabili.

SAB Zenzele Kabili is a black economic empowerment (BEE) share scheme established by SAB (South African Breweries) to provide an opportunity for its black shareholders to participate in the company’s growth and prosperity. The scheme has been launched in 2021, and the shares can be bought and sold through EasyEquities.

EasyEquities, on the other hand, is a South African online investment platform that allows individuals to buy and sell shares, exchange-traded funds (ETFs), and other investment products. The platform is designed to be user-friendly and accessible, making it easy for first-time investors to get started with investing.

In summary, SAB Zenzele Kabili is an investment opportunity for black shareholders in SAB, and EasyEquities provides a platform for investors to buy and sell SAB Zenzele Kabili shares.

ALSO READ: Who Is George Van Der Riet?

How to Purchase SAB Zenzele Shares?

To purchase SAB Zenzele Kabili shares, you need to follow these steps:

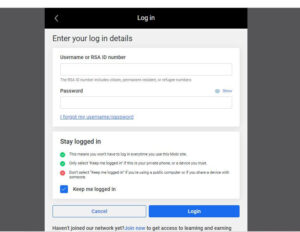

- Open an account with EasyEquities: You can do this by visiting the EasyEquities website or downloading the EasyEquities app from the App Store or Google Play. You will need to provide your personal information and complete the verification process.

- Fund your account: You will need to deposit funds into your EasyEquities account to purchase SAB Zenzele Kabili shares. You can do this using various payment methods such as EFT, debit card, or credit card.

- Search for SAB Zenzele Kabili shares: Once your account is funded, you can search for SAB Zenzele Kabili shares using the EasyEquities platform. You can find the shares by searching for “SAB” or “SAB Zenzele” in the search bar.

- Place an order: After you have found the SAB Zenzele Kabili shares, you can place an order to buy the shares. You will need to enter the number of shares you want to purchase and the price you are willing to pay.

- Confirm the order: After placing the order, you will need to confirm the details and accept the terms and conditions.

- Monitor your investment: Once your order is executed, you will own the SAB Zenzele Kabili shares, and you can monitor the performance of your investment through the EasyEquities platform.

It is essential to note that the availability of SAB Zenzele Kabili shares on the EasyEquities platform is subject to demand and availability.

Conclusion

In conclusion, to purchase SAB Zenzele Kabili shares, you need to open an account with EasyEquities, fund your account, search for the SAB Zenzele Kabili shares on the platform, place an order, confirm the details, and monitor your investment. EasyEquities provides an easy-to-use platform for investors to buy and sell shares, ETFs, and other investment products. SAB Zenzele Kabili is an investment opportunity for black shareholders in SAB, and EasyEquities provides a platform for investors to buy and sell SAB Zenzele Kabili shares. It’s important to note that the availability of SAB Zenzele Kabili shares on the EasyEquities platform is subject to demand and availability.

Image Courtesy: YouTube