Boodle Loans provides instant loans as a licensed lender under the NCR. Reviews on Boodle vary, with some individuals praising their customer service and quick payday loans. Boodle’s online platform is lauded for its simplicity and ease of use, capable of verifying your credit rating to determine loan eligibility.

ALSO READ: How To Apply For Boodle Loans in South Africa

Once approved, funds are swiftly deposited into your account in under 10 minutes. Negative comments typically stem from individuals who either didn’t qualify for a loan or are still awaiting approval. Boodle addresses these concerns by requesting additional information to help find a suitable solution. This article provides an in-depth review of Boodle Loans, covering its advantages, drawbacks, and application requirements.

What Boodle Loans Offers

Boodle Loans is a quick loan provider extending loans within 10 minutes post-approval. Specializing in instant, short-term financial solutions like payday and personal loans, Boodle is known for its accommodating customer service. New customers can apply for loans of up to R3,000 with repayment terms spanning from 2 to 32 days. For clients with a proven track record of timely repayments, Boodle offers the possibility of accessing higher loan amounts.

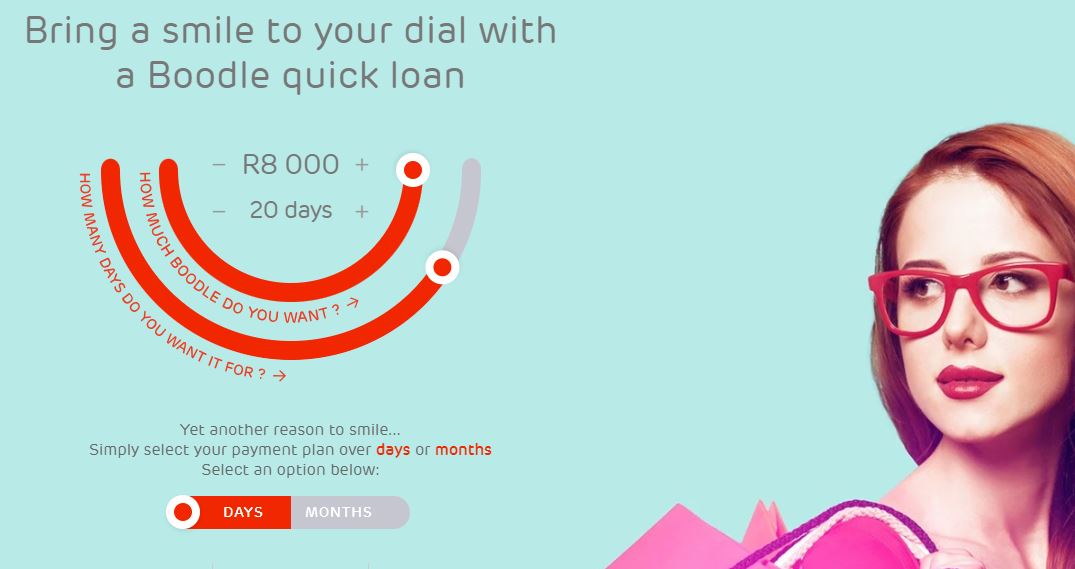

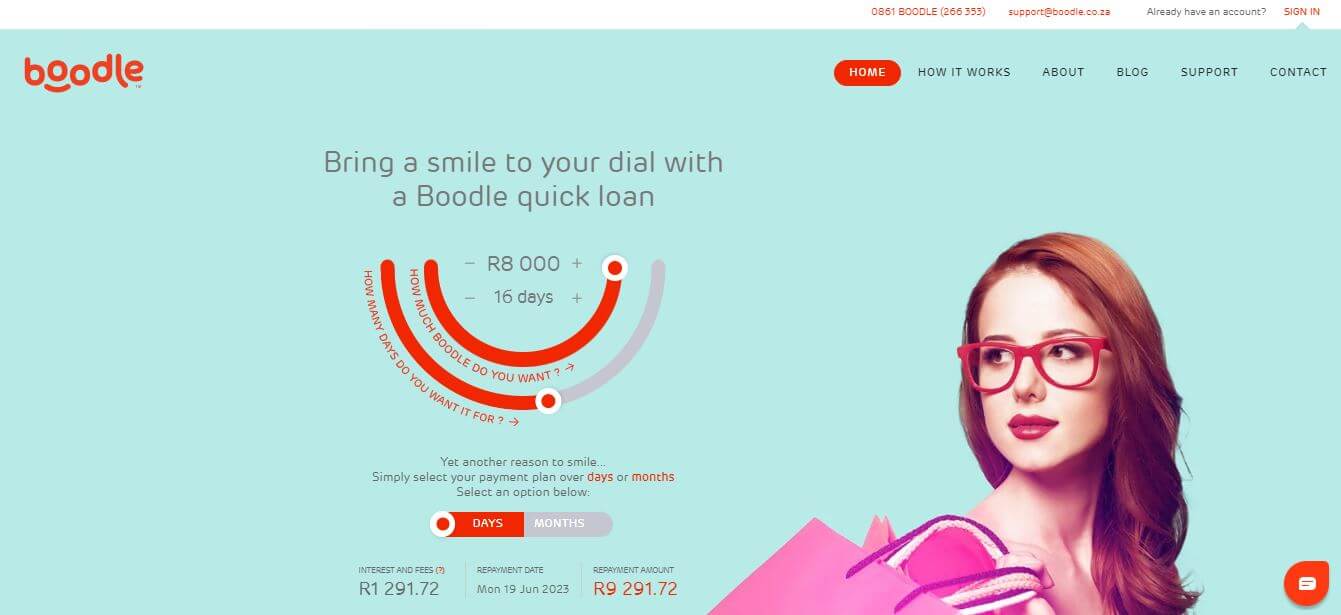

Boodle Loans Smile Ranking System

Once you attain the status of a preferred lender through their distinctive smile rating system, Boodle rewards you with a smile to enhance your smile rank every time a previous loan is repaid. Accumulating smiles boosts your rating, thereby qualifying you for loans of up to R8,000.

Is Boodle Loan Legit In South Africa?

For those questioning the legitimacy of Boodle Loans, they can rest assured knowing that Boodle is a registered lending company that adheres to the regulations established by the NCR (National Credit Regulator).

How To Boodle Loans Online Loan Calculator

On Boodle Loans’ official website, you can access their online calculator, providing a comprehensive breakdown of all fees linked to your prospective loan. Their calculator is transparent, clearly displaying all associated costs. With Boodle, you can anticipate a service fee of R60.00, inclusive of VAT, alongside an initiation fee of R165.00, plus 10% of the loan amount lent, including VAT. Interest is charged daily at a rate of 0.74%.

Boodle Loans’ Interest Rate Change For Loan Payments

Boodle Loans’ interest rate directly impacts the total cost of borrowing and thus influences loan payments. Here’s how:

- Higher Interest Rate = Higher Total Cost: A higher interest rate means you’ll pay more in interest over the loan term. This increases the total amount you repay.

- Impact on Monthly Payments: With a higher interest rate, your monthly payments may be higher because you’re not only repaying the principal amount borrowed but also the interest accrued.

- Longer Loan Term, More Interest: If you opt for a longer loan term, even with a relatively low-interest rate, you end up paying more interest over time because the interest accrues for a longer period.

- Lower Interest Rate Saves Money: Conversely, a lower interest rate reduces the total cost of borrowing and may result in lower monthly payments. This makes the loan more affordable in the long run.

Therefore, understanding and comparing interest rates offered by lenders like Boodle Loans is crucial in determining the affordability and overall cost of the loan.

Boodle Loan Application Special Requirements

The eligibility criteria for a Boodle loan are clear-cut. Applicants must possess a valid South African Identity Document and be at least 18 years old. Additionally, they should have an active South African bank account, internet access, and a consistent monthly income.

Can I Only Find Payday loans At Boodle?

Boodle offers repayment periods ranging from 2 to 32 days, primarily catering to short-term borrowing needs like payday loans. Currently, there are no options for long-term loans available from Boodle.

Boodle Loans Benefits

Boodle, functioning as an online lending platform, prides itself on its rapid and straightforward process. Their loan application procedures are streamlined, ensuring a hassle-free experience for users. The system swiftly evaluates and approves applicants, often depositing funds into their bank accounts within just 10 minutes. It’s an efficient, paperless platform featuring a user-friendly interface. Users also have the option to engage in live chat with knowledgeable representatives for any further inquiries. Boodle maintains transparency by openly disclosing loan costs, ensuring no hidden charges surprise borrowers before they accept their potential loan.

Boodle Loans Cons

Given the repayment window of only 2 to 32 days, clients should anticipate higher interest rates and fees compared to traditional bank short-term loans. Boodle specializes in payday loans, prioritizing convenience; however, this focus may limit flexibility in repayment options.

Boodle Loan FAQs

Here are some frequently asked questions (FAQs) about Boodle loans:

What are the eligibility criteria for a Boodle loan?

To qualify for a Boodle loan, you typically need to be over 18 years old, possess a valid South African Identity Document, have a South African bank account, access to the internet, and a regular monthly income.

How fast can I expect to receive funds from Boodle?

Boodle aims for a rapid process, often depositing funds into approved borrowers’ bank accounts within 10 minutes of approval.

What is the repayment period for Boodle loans?

Boodle offers repayment terms ranging from 2 to 32 days, tailored to short-term borrowing needs like payday loans.

Are there long-term loan options available from Boodle?

Currently, Boodle specializes in short-term loans, and long-term loan options are not available.

How transparent is Boodle about its loan costs?

Boodle maintains transparency by openly disclosing loan costs, ensuring there are no hidden charges before borrowers accept their potential loan.

Is there flexibility in repayment options with Boodle loans?

Due to the short repayment period, flexibility in repayment options may be limited with Boodle loans. However, borrowers can contact Boodle’s customer service for assistance or clarification.

Can I contact Boodle for further assistance or inquiries?

Yes, Boodle provides a user-friendly platform with the option for live chat with qualified representatives to address any additional queries or concerns.

These FAQs should provide a comprehensive overview of Boodle loans and address common inquiries potential borrowers may have.

Conclusion

In conclusion, Boodle loans offer a fast and convenient solution for short-term financial needs, primarily focusing on payday loans. With a streamlined application process and rapid approval times, borrowers can expect funds to be deposited into their accounts within minutes. The platform’s user-friendly interface and transparent disclosure of costs contribute to a positive borrowing experience. However, clients should be aware that due to the short repayment period of 2 to 32 days, interest rates and fees may be higher compared to traditional bank loans, and flexibility in repayment options may be limited. Overall, Boodle serves as a reliable option for individuals seeking quick access to funds for immediate financial requirements.

Image Courtesy: www.boodle.co.za