EPFO stands for the “Employees’ Provident Fund Organization.” It is a statutory body under the Ministry of Labour and Employment, Government of India. The EPFO is responsible for managing and administering social security schemes that provide financial benefits and social security to employees in India.

What Is EPFO?

EPFO stands for Employees’ Provident Fund Organisation. It’s a statutory body established by the Government of India under the Ministry of Labour and Employment. It’s one of the largest social security organizations in India, managing retirement savings for a significant portion of the workforce.

Here are some key points about EPFO:

- Function: Manages the Employees’ Provident Funds (EPF) Scheme and other social security schemes for organized sector employees in India.

- Role:

- Collects contributions from both employees (12% of basic salary) and employers (matching contribution of 12% of basic salary).

- Manages the investment and growth of these contributions.

- Provides various benefits to members like pension, insurance, and lump-sum payments on retirement or other specific events.

- Eligibility: Applies to most employees working in establishments with 20 or more employees (certain exemptions exist).

- Benefits: Offers various benefits to members, including:

- Pension after retirement: Provides a monthly pension upon reaching retirement age.

- Life insurance: Offers life insurance coverage to members and their families.

- Provident fund: Allows members to accumulate savings through contributions, which they can withdraw partially or fully under specific circumstances.

- Other benefits: May include unemployment benefits and disability benefits depending on the specific scheme.

Overall, EPFO plays a crucial role in ensuring the financial security and well-being of millions of Indian employees by providing them with retirement savings and other social security benefits.

EPFO Functions And Features

Key functions and features of EPFO include:

- Provident Fund (PF): EPFO manages the Employees’ Provident Fund, which is a mandatory savings scheme for salaried employees. Both employers and employees contribute a certain percentage of the employee’s salary to this fund.

- Employees’ Pension Scheme (EPS): The Employees’ Pension Scheme is also managed by EPFO. It provides a pension to employees after their retirement.

- Employees’ Deposit-Linked Insurance (EDLI): EPFO administers the Employees’ Deposit-Linked Insurance scheme, which provides life insurance coverage to employees.

- Universal Account Number (UAN): UAN is a unique 12-digit number assigned to each member of EPFO to link multiple Member Identification Numbers (Member IDs) allotted to a single member under a single UAN.

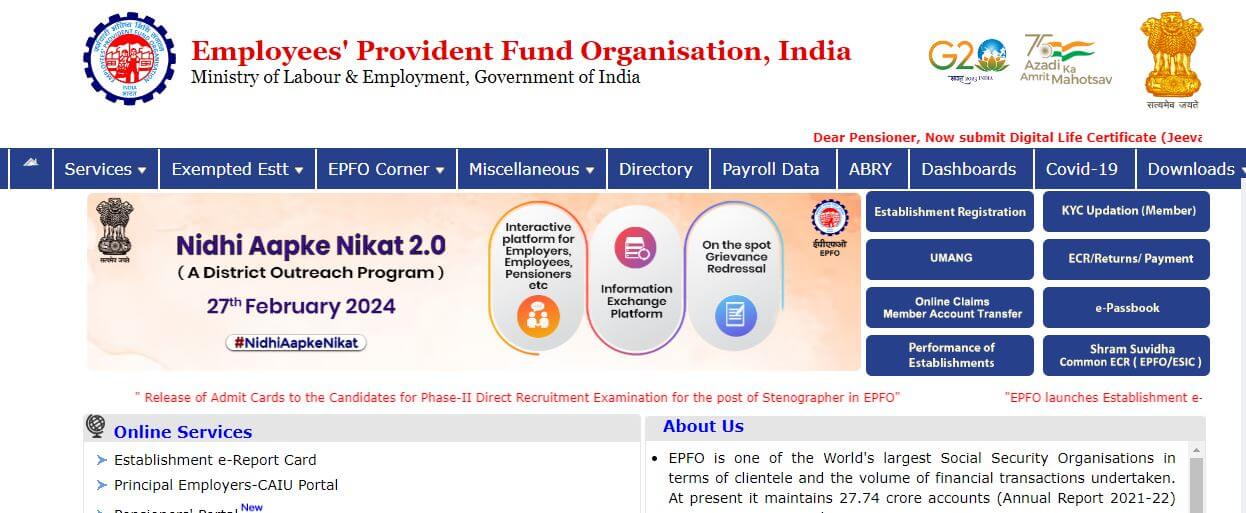

- Online Services: EPFO provides various online services, including UAN activation, checking EPF balance, updating KYC details, and submitting withdrawal claims through the Member e-Sewa portal.

- EPF Passbook: Employees can check their EPF balance, contributions, and transactions through the EPF passbook available on the EPFO portal.

- Employer E-Sewa: Employers can manage EPF-related tasks online through the Employer E-Sewa portal, such as filing monthly returns, updating employee details, and generating Electronic Challan cum Return (ECR) for contributions.

- EPFO Mobile App: EPFO offers a mobile app that allows members to access various services and information related to their provident fund account.

The EPFO plays a crucial role in safeguarding the financial interests of employees in the organized sector. It ensures that employees receive a lump sum amount on retirement and a pension for financial security during their post-employment years. The organization operates through regional offices across India and is governed by the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952.

EPFO Frequently Asked Questions (FAQs)

-

Who is eligible for EPFO membership?

- Most employees working in establishments with at least 20 employees are eligible.

- Employees earning more than Rs. 15,000 per month can opt-in voluntarily.

-

How do I know if I am enrolled under EPFO?

- You can check your UAN (Universal Account Number) on your payslip or by registering on the EPFO website (https://www.epfindia.gov.in/).

-

What is the process for registration under EPFO?

- Your employer is responsible for registering you with EPFO.

-

What is the contribution rate for EPF?

- Both employee and employer contribute 12% of the employee’s basic salary, subject to a maximum of Rs. 15,000 per month.

-

How are EPF contributions deposited?

- Contributions are deposited into the member’s account linked to their UAN.

-

How can I check my EPF balance?

- You can check your balance online using your UAN on the EPFO website or mobile app.

-

What are the different types of claims I can make under EPFO?

- You can claim various benefits under different circumstances, including:

- Full or partial withdrawal upon retirement

- Withdrawal for other specific reasons (marriage, medical emergencies, etc.)

- Pension after reaching retirement age

- Insurance benefits in case of death

- You can claim various benefits under different circumstances, including:

-

How do I file a claim under EPFO?

- Claims can be filed online through the EPFO website or mobile app using your UAN.

-

What documents are required for filing a claim?

- Required documents vary depending on the type of claim. You can find a detailed list on the EPFO website.

-

What is UAN?

- The Universal Account Number (UAN) is a unique identification number assigned to each EPFO member. It remains constant throughout your employment, even if you change jobs.

-

How can I contact EPFO for further assistance?

- You can contact EPFO through their toll-free number (14470) or by sending an email through their website.

Disclaimer: This information is for general guidance only. It’s advisable to refer to the official EPFO website (https://www.epfindia.gov.in/) for the most up-to-date and accurate information.

Conclusion

Understanding the Employees’ Provident Fund Organisation (EPFO) is crucial for millions of Indian employees as it significantly impacts their financial security and well-being. By enrolling in the EPF scheme and actively managing your contributions and benefits, you can utilize this program effectively to secure a financially stable future.

Remember, the EPFO website (https://www.epfindia.gov.in/) is your primary source for the latest information and official guidelines. Feel free to explore the website and contact their helpdesk if you have any further questions related to your specific situation.

Image Courtesy: https://www.epfindia.gov.in/site_en/index.php