The UIF Salary Schedule Form is a document that employers in South Africa must complete for their employees. It provides the Unemployment Insurance Fund (UIF) with information about the employee’s salary and benefits, which is used to calculate the employee’s unemployment insurance contributions.

The UIF Salary Schedule Form is required by law, and employers who fail to complete it may be fined. The form is also important for employees, as it ensures that they are making the correct contributions to the UIF and will be eligible for benefits if they become unemployed.

The UIF Salary Schedule Form is a relatively simple document to complete, but it is important to understand the different sections of the form and how to fill them in correctly. This guide will provide you with a step-by-step overview of how to complete the UIF Salary Schedule Form.

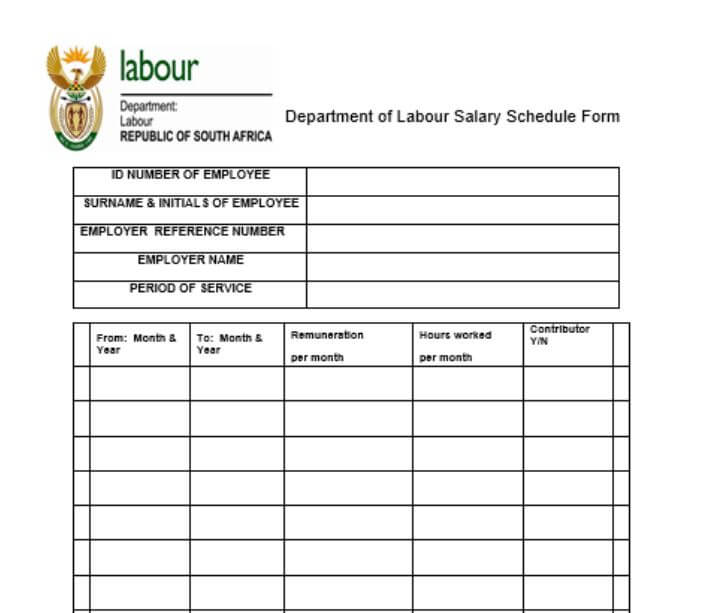

What Is UIF Salary Schedule Form?

The UIF (Unemployment Insurance Fund) Salary Schedule Form is a document used in South Africa to report employee salary information to the UIF. The UIF is a government program that provides short-term financial assistance to workers who are unemployed or unable to work due to various reasons, including retrenchment, illness, or maternity leave. Employers are required to contribute to the UIF on behalf of their employees.

The UIF Salary Schedule Form is important for compliance with labor laws in South Africa and for ensuring that employees have access to UIF benefits when needed. Employers must accurately complete and submit this form to the UIF as part of their legal obligations.

What Does The UIF Salary Schedule Form Include?

The UIF Salary Schedule Form typically includes the following information:

- Employee Details: This section contains information about the employees covered by the form, such as their names, identity numbers, and employment details.

- Income Information: Employers are required to report the income earned by each employee. This includes details of their earnings, bonuses, and other income sources.

- Deductions: The form may include information about any statutory deductions made from the employee’s salary, such as income tax, UIF contributions, and other mandatory deductions.

- Employer Contributions: Employers are responsible for contributing to the UIF on behalf of their employees. The form may include details of these contributions.

- UIF Reference Numbers: Both the employer and employee typically have UIF reference numbers that are used to link contributions to specific individuals and organizations. These numbers may be included on the form.

- Period Covered: The form specifies the period for which the salary information is being reported. This helps ensure that contributions are correctly allocated to the corresponding time frame.

How To Complete UIF Salary Schedule Form?

To complete the UIF Salary Schedule Form, you will need to provide the following information:

Section 1: Employee Details

- Employee Identification Number

- Full Name

- Date of Appointment

- Date of Termination (if applicable)

Section 2: Employer Details

- Employer Reference Number

- Employer Name

- Employer Address

- Employer Contact Details

Section 3: Period of Service

- Start Date

- End Date

Section 4A & B: Hours Worked Per Week/Month

- Number of hours worked per week

- Number of hours worked per month

Section 5: Salary

- Basic Salary

- Overtime Pay

- Allowances

- Other Income

- Total Salary

Section 6: Unemployment Insurance Contributions

- UIF Contribution Rate

- UIF Contribution Amount

Section 7: Declaration

- Signature of Employer

- Date

Once you have completed the form, you will need to submit it to the Unemployment Insurance Fund (UIF). You can do this electronically or by mail.

Here are some tips for completing the UIF Salary Schedule Form:

- Make sure that you have all of the required information before you start filling out the form.

- Be clear and concise when filling out the form.

- Use black ink and write neatly.

- Double-check your work before submitting the form.

Where Can I Get UIF Salary Schedule Form?

You can get the UIF Salary Schedule Form from the following sources:

- UIF website: Download the form from the UIF website in PDF or Excel format.

- Nearest UIF branch: Visit your nearest UIF branch to request a physical copy of the form.

- Labor Department: Visit your nearest Labor Department office to request a physical copy of the form.

- Your employer: Your employer may have copies of the UIF Salary Schedule Form available for you.

Once you have the form, you can complete it and submit it to the UIF electronically or by mail.

Here are the steps on how to submit the UIF Salary Schedule Form electronically:

- Go to the UIF website and login to your account.

- Click on the “Forms” tab.

- Select the “UIF Salary Schedule Form” and click on the “Download” button.

- Open the form and complete it accurately.

- Save the form.

- Click on the “Submit” button.

Here are the steps on how to submit the UIF Salary Schedule Form by mail:

- Print the completed form.

- Sign and date the form.

- Mail the form to the following address:

Unemployment Insurance Fund P.O. Box 7019 Centurion 0046

Please note that it may take up to 14 days for the UIF to process your form. You will receive a notification from the UIF once your form has been processed.

FAQs

Here are some frequently asked questions about the UIF Salary Schedule Form:

Q: Who needs to complete the UIF Salary Schedule Form?

A: All employers in South Africa are required to complete the UIF Salary Schedule Form for their employees. This includes employers of all sizes, from small businesses to large corporations.

Q: How often do I need to complete the UIF Salary Schedule Form?

A: You need to complete the UIF Salary Schedule Form whenever you make a change to an employee’s salary or benefits. This includes changes to the employee’s basic salary, overtime pay, allowances, and other income.

Q: What happens if I don’t complete the UIF Salary Schedule Form?

A: If you don’t complete the UIF Salary Schedule Form, you may be fined by the UIF. You may also be liable for back payments of UIF contributions.

Q: How do I submit the UIF Salary Schedule Form?

A: You can submit the UIF Salary Schedule Form electronically or by mail. To submit the form electronically, you will need to log in to your account on the UIF website. To submit the form by mail, you will need to print the completed form and mail it to the UIF address listed above.

Q: How long does it take for the UIF to process the UIF Salary Schedule Form?

A: It may take up to 14 days for the UIF to process the UIF Salary Schedule Form. You will receive a notification from the UIF once your form has been processed.

If you have any other questions about the UIF Salary Schedule Form, you can contact the UIF directly.

Conclusion

The UIF Salary Schedule Form is an important form that employers in South Africa need to complete for their employees. The form provides the UIF with information about the employee’s salary and benefits, which is used to calculate the employee’s unemployment insurance contributions.

It is important to complete the UIF Salary Schedule Form accurately and on time. Employers who fail to do so may be fined by the UIF or liable for back payments of UIF contributions.

Image Courtesy: sainsider