Introduction

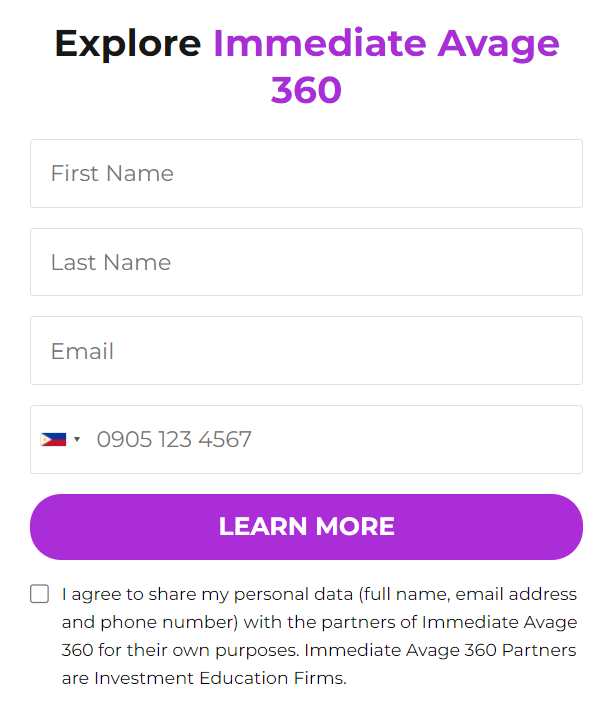

Cryptocurrency investment platforms have become increasingly popular in recent years, offering investors the opportunity to trade digital assets and participate in various investment opportunities. However, with the rise in popularity of these platforms comes an increased risk of security threats. Evaluating the security of cryptocurrency investment platforms is crucial for investors to protect their funds and personal information from potential breaches. In this article, we will delve into the various aspects of security that investors should consider when evaluating cryptocurrency investment platforms. To ensure the safety of your investments and personal information on cryptocurrency platforms, it’s essential to evaluate their security measures carefully—click the image below for a detailed examination of key security considerations.

Understanding Security Risks in Cryptocurrency

Cryptocurrency platforms face a unique set of security challenges due to the decentralized and digital nature of cryptocurrencies. One of the most significant risks is hacking, where malicious actors attempt to gain unauthorized access to the platform’s systems to steal funds or sensitive information. Additionally, phishing attacks are prevalent, where scammers trick users into revealing their login credentials or private keys through fraudulent emails or websites. Moreover, malware targeting cryptocurrency users can compromise the security of their devices and steal their cryptocurrency holdings.

Key Security Features to Look For

When evaluating the security of cryptocurrency investment platforms, several key features should be considered. Two-factor authentication (2FA) adds an extra layer of security by requiring users to provide a second form of verification, such as a unique code sent to their mobile device, in addition to their password. Encryption is another essential security feature that protects users’ data by encoding it in such a way that only authorized parties can access it. Secure wallets, both hot and cold, are crucial for storing cryptocurrencies safely, with cold wallets being offline and thus less vulnerable to hacking attempts.

Regulatory Compliance

Regulatory compliance is essential for ensuring the security and legitimacy of cryptocurrency investment platforms. Platforms that comply with relevant regulations are more likely to adhere to best practices for security and investor protection. Investors should verify that a platform is registered with the appropriate regulatory authorities and complies with know-your-customer (KYC) and anti-money laundering (AML) regulations. Additionally, platforms that implement robust compliance measures are less likely to engage in fraudulent activities or facilitate illicit transactions.

Third-party audits and Security Certifications

Third-party audits and security certifications provide independent verification of a platform’s security measures and adherence to industry standards. Investors should look for platforms that undergo regular audits conducted by reputable cybersecurity firms. These audits assess the platform’s security protocols, vulnerability management, and compliance with industry regulations. Additionally, security certifications such as ISO 27001 and SOC 2 demonstrate that a platform has implemented comprehensive security controls and practices to protect users’ assets and data.

User Reviews and Reputation

User reviews and the platform’s reputation are valuable sources of information for evaluating security. Investors should research and analyze user feedback to gauge the platform’s reliability, security, and customer service. Negative reviews or reports of security breaches should raise red flags and prompt further investigation. Additionally, platforms with a strong reputation in the cryptocurrency community are more likely to prioritize security and take proactive measures to protect their users.

Security Incident Response and Insurance

A platform’s incident response plan is crucial for mitigating the impact of security breaches and protecting investors’ funds. Investors should inquire about the platform’s procedures for detecting, responding to, and recovering from security incidents. Additionally, platforms that offer insurance coverage for users’ funds provide an extra layer of protection against potential losses due to security breaches. Investors should verify the extent of insurance coverage and understand the terms and conditions for filing a claim in the event of a security breach.

Conclusion

In conclusion, evaluating the security of cryptocurrency investment platforms is essential for investors to safeguard their funds and personal information. By understanding the security risks inherent in cryptocurrency investments and considering key security features such as two-factor authentication, encryption, and secure wallets, investors can make informed decisions when choosing a platform. Regulatory compliance, third-party audits, user reviews, and incident response plans are additional factors to consider when assessing platform security. By conducting thorough due diligence and prioritizing security, investors can minimize their exposure to security threats and protect their investments in the ever-evolving landscape of cryptocurrency.

Image Courtesy: Unsplash