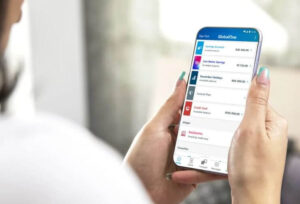

How to send money using Capitec app in South Africa? In today’s digital age, sending money to friends and family has become easier than ever before, thanks to the use of mobile banking apps. Capitec Bank, one of South Africa’s leading banks, offers a user-friendly app that allows customers to send money quickly and securely to anyone with a South African bank account. In this guide, we’ll walk you through the simple steps of sending money using the Capitec app in South Africa, so you can enjoy the convenience of mobile banking and stay connected with your loved ones, no matter where they are.

ALSO READ: How to Check Capitec Balance Without App?

How to Send Money Using Capitec App in South Africa

Sending money using the Capitec app in South Africa is a straightforward process. Here’s how to do it:

- Open the Capitec app on your smartphone and log in to your account.

- Select the “Transact” option on the home screen.

- Click on “Pay beneficiary.”

- Select the recipient from your contact list or add a new recipient by entering their cellphone number and selecting their bank

- Confirm the recipient’s details.

- Enter the amount you wish to send.

- Add a reference for the transaction if you want.

- Verify that the details are correct and click “Pay.”

Once the transaction is complete, you and the recipient will receive SMS notifications. The money will be available immediately in the recipient’s account, depending on their bank’s processing times.

Please note that you must be a Capitec Bank customer and have sufficient funds in your account to complete the transaction. There may also be transaction fees involved, depending on the recipient’s bank and the type of account they have.

How To Download Capitec App

Downloading the Capitec app is easy and can be done in a few simple steps. Here’s how to download the Capitec app on your smartphone:

- Open the App Store or Google Play Store on your smartphone.

- In the search bar, type “Capitec Bank” and select the Capitec app from the search results.

- Click on “Install” or “Get” to download the app.

- Once the download is complete, open the Capitec app.

- Follow the prompts to set up your account, including entering your personal and banking details, creating a password and PIN, and verifying your identity.

After completing these steps, you’ll be able to use the Capitec app to manage your account, check your balances, view your transaction history, and send money to other South African bank accounts. Please note that you must have an active Capitec Bank account to use the app.

Capitec Bank App Features

The Capitec app offers a range of features that allow customers to manage their accounts, track their finances, and send money quickly and securely. Here are some of the key features of the Capitec app:

- Balance enquiry: You can view your account balances and transaction history on the app.

- Transaction history: The app provides a detailed transaction history for all your Capitec Bank accounts, including your savings, loan, and credit card accounts.

- Money transfers: You can send money to other South African bank accounts using the app, and also receive money from others.

- Bill payments: The app allows you to pay your bills and make other payments, such as airtime and data bundles.

- Savings goals: You can set savings goals and track your progress towards them using the app.

- Branch and ATM locator: The app provides a map with the locations of the nearest Capitec Bank branches and ATMs.

- Card management: You can manage your Capitec Bank debit or credit card on the app, including activating, deactivating, or replacing your card.

- Security: The app uses advanced security features, such as fingerprint and facial recognition, to protect your personal and financial information.

Overall, the Capitec app offers a user-friendly interface and a wide range of features that make it easy for customers to manage their finances on the go.

FAQs

Is it necessary to have a Capitec Bank account to use the Capitec app for sending money?

Yes, you must be a Capitec Bank customer with an active account to use the Capitec app for sending money.

Is there a limit to the amount of money that can be sent using the Capitec app?

Yes, there are daily and monthly limits on the amount of money that can be sent using the Capitec app. These limits may vary depending on your account type and other factors.

Are there any transaction fees involved when sending money using the Capitec app?

Capitec Bank charges a fee for sending money using the app. The fee varies depending on the amount of money being sent and the recipient’s bank.

How long does it take for the recipient to receive the money sent through the Capitec app?

The money sent through the Capitec app is usually available immediately in the recipient’s account, depending on their bank’s processing times.

Is it safe to send money using the Capitec app?

Yes, the Capitec app uses advanced security features to protect your personal and financial information. However, you should always take precautions to protect your login credentials and other sensitive information.

Conclusion

In conclusion, sending money using the Capitec app in South Africa is a simple and convenient way to stay connected with your loved ones. With its user-friendly interface and advanced security features, the Capitec app makes it easy to send money quickly and securely to anyone with a South African bank account. However, it’s important to be aware of the daily and monthly limits, transaction fees, and other factors that may affect your transaction. By following the steps outlined in this guide and taking necessary precautions to protect your personal and financial information, you can enjoy the benefits of mobile banking and stay connected with your loved ones, no matter where they are.

Image Courtesy: YouTube