The Capitec Personal Loan Calculator is a tool provided by Capitec Bank on their website or mobile app that helps individuals estimate the costs associated with taking out a personal loan from Capitec South Africa. Capitec Bank is a financial institution based in South Africa that offers various banking and financial services, including personal loans.

Users can input variables such as the desired loan amount, repayment period, and interest rate to calculate the monthly repayment amount, total repayment amount, and other relevant details. This Capitec Loan Calculator is handy for potential borrowers to understand the financial implications of taking out a personal loan and to plan their finances accordingly. In this article, you will learn how to use the Capitec Personal Loan Calculator.

ALSO READ: How To Download Capitec App For Android Phone?

What Is Capitec Personal Loan Calculator?

The Capitec personal loan calculator is a tool provided by Capitec Bank that allows individuals to estimate the cost of borrowing money through a personal loan.

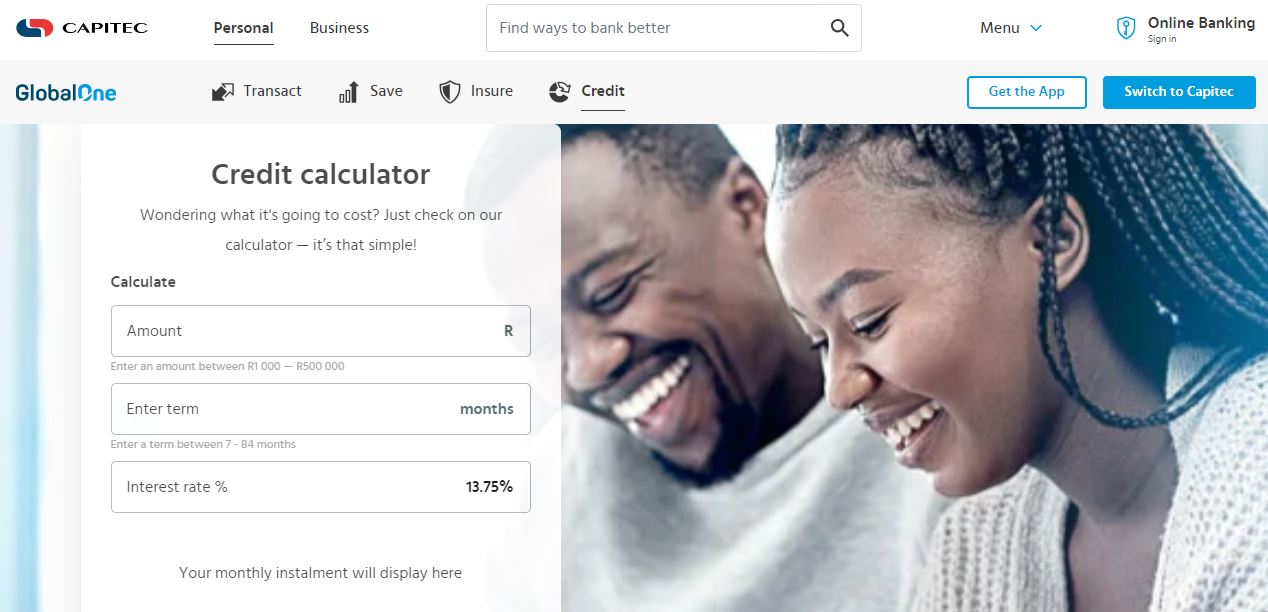

Capitec Bank provides a credit calculator tool within their credit tools section https://www.capitecbank.co.za/personal/credit/rates-and-fees/.

This Capitec loan calculator acts similarly to a personal loan calculator. It allows you to estimate your monthly repayments for a personal loan by factoring in:

- The loan amount you wish to borrow (between R1,000 and R500,000)

- The repayment term (between 7 and 84 months)

- The interest rate (which will vary based on your credit profile and will likely fall between 13.75% and 22.25%)

By using this tool, you can get an idea of how much your monthly repayments would be and the total cost of the loan before applying for a Capitec personal loan.

How To Use Capitec Personal Loan Calculator?

Capitec doesn’t have a separate personal loan calculator, but their credit calculator [https://www.capitecbank.co.za/personal/credit/rates-and-fees/] works similarly. Here’s how to use it:

- Go to the Capitec credit tools section https://www.capitecbank.co.za/personal/credit/rates-and-fees/.

- Look for the section titled “Credit calculator“.

- There will be three boxes to fill in:

- Amount: Enter the loan amount you’re considering (between R1,000 and R500,000).

- Term: Enter your desired loan repayment period in months (between 7 and 84 months).

- Interest rate: This section won’t let you input a rate, but it will display a representative interest rate based on your credit profile. Keep in mind actual rates may differ.

- Once you’ve entered your desired loan amount and term, the calculator will automatically estimate your monthly repayment amount.

This will give you a rough idea of how much the loan would cost you each month. Remember, the actual interest rate you receive might be different based on your creditworthiness.

Capitec Personal Loan Calculator FAQs

Capitec Personal Loan Calculator FAQs (Since Capitec uses a credit calculator for personal loans)

1. Does Capitec have a separate Personal Loan Calculator?

No, Capitec doesn’t offer a specific Personal Loan Calculator. They have a credit calculator tool within their credit tools section https://www.capitecbank.co.za/personal/credit/credit-tools/

2. How can I use the Credit Calculator for Personal Loans?

- Visit Capitec’s credit tools section https://www.capitecbank.co.za/personal/credit/credit-tools/.

- Find the “Credit calculator” section.

- Input the following details:

- Amount: Your desired loan amount (between R1,000 and R500,000).

- Term: The loan repayment period in months (between 7 and 84 months).

- The interest rate cannot be directly entered. The calculator displays a representative interest rate based on your credit profile, but the actual rate may differ.

- Once you enter the loan amount and term, the calculator will estimate your monthly repayment.

3. What does the estimated monthly repayment tell me?

The estimated monthly repayment gives you a general idea of how much your monthly loan payment would be based on the entered loan amount and term. It’s important to remember that the actual interest rate you receive may differ depending on your creditworthiness, potentially affecting the final monthly payment.

4. Can I get a pre-approval for a loan amount using the calculator?

No, the credit calculator only provides an estimate. To get pre-approved for a specific loan amount and interest rate, you’ll need to apply for a personal loan with Capitec.

5. Are there any other factors to consider besides the monthly repayment?

Yes, there are other factors to consider:

- Total cost of the loan: The calculator only shows the monthly repayment, but it doesn’t show the total interest you’ll pay over the loan term. Consider factoring in the total interest cost to understand the loan’s full financial impact.

- Credit score impact: Applying for a loan can affect your credit score.

- Eligibility: The calculator doesn’t determine your eligibility for a loan. You’ll need to apply to see if you qualify.

Conclusion

In conclusion, the Capitec Personal Loan Calculator is a helpful tool provided by Capitec Bank in South Africa. It enables users to estimate the costs associated with taking out a personal loan from Capitec by inputting variables such as loan amount, repayment period, and interest rate. This calculator assists borrowers in understanding the financial obligations of the loan, facilitating better financial planning and decision-making.

Image Courtesy: https://www.capitecbank.co.za/personal/credit/credit-tools/