How to Check Capfin Loan Statement In South Africa? Keeping track of your finances has never been smoother! Staying informed about your Capfin loan is crucial for responsible repayment and financial peace of mind. But with busy schedules and diverse preferences, the question of “how to check Capfin loan statement in South Africa” can linger. Fear not, borrowers! This comprehensive guide uncovers both online and offline avenues to easily access your statement anytime, anywhere. From the secure self-service portal brimming with features to the quick and convenient SMS option, we’ll explore your options so you can choose the method that best suits your needs. So, whether you’re a tech-savvy pro or prefer a simpler approach, buckle up and get ready to demystify the process of checking your Capfin loan statement like a seasoned financial navigator!

ALSO READ: How Do I Apply for Capfin Loan via SMS?

What Is Capfin Loan?

Capfin Loan is a personal loan product offered by Capfin, a financial services provider based in South Africa. They specifically aim to offer affordable and easy-to-manage loans for borrowers who may not have access to traditional banking services.

Here’s a breakdown of what Capfin Loan entails:

Loan Amounts:

- They offer loans of up to R50,000, though the actual amount you qualify for will depend on your creditworthiness and affordability assessment.

- Loan terms are short-term, with options for 6 or 12 months repayment periods.

Key Features:

- Transparency: They emphasize transparent loan products with no hidden fees or interest rates.

- Convenient application: You can apply online, at PEP or Ackermans stores, or via USSD code.

- Easy accessibility: No bank statements are required for smaller loans, and direct bank statement verification is available.

- 24/7 account access: You can manage your loan and view statements through their secure online portal.

- Responsible lending: They conduct affordability assessments to ensure you can manage the repayments comfortably.

Things to consider:

- Interest rates on Capfin Loans may be higher compared to traditional banks, especially for smaller loan amounts.

- Short-term repayments can mean larger monthly installments.

- It’s crucial to thoroughly read and understand the loan terms and conditions before applying.

Here are some additional resources you might find helpful:

- Capfin Website: https://www.capfin.co.za/

- Capfin FAQ: https://www.capfin.co.za/faq

- National Credit Regulator website: https://nationalgovernment.co.za/units/view/126/national-credit-regulator-ncr

How to Check Capfin Loan Statement In South Africa?

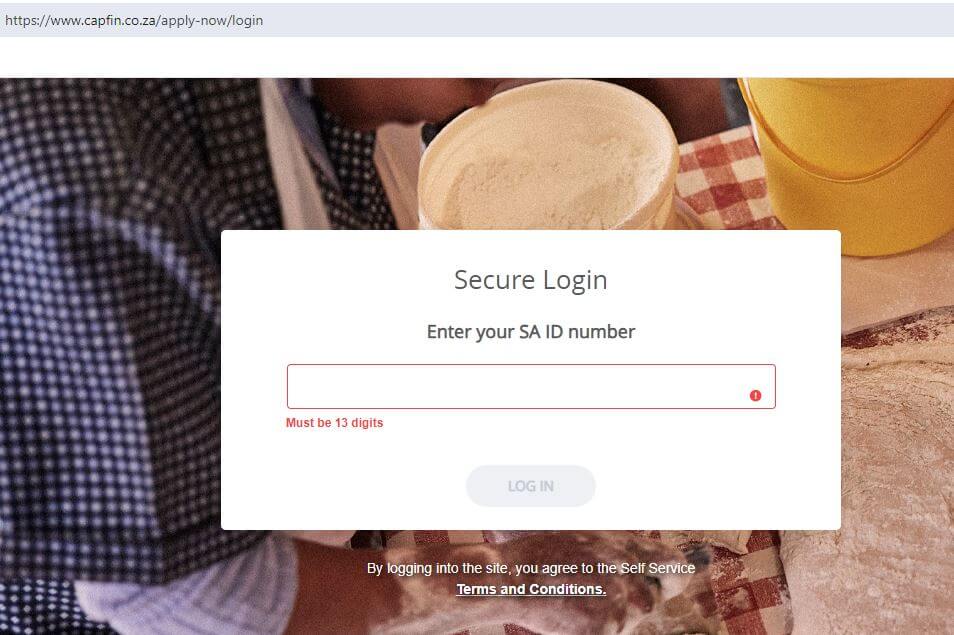

Here’s how to check your Capfin loan statement online:

- Visit the Capfin Loan website: https://www.capfin.co.za/

- Click “Login” at the top right corner.

- Enter your SA ID number and click “Login”

- An OTP code will be sent to your cell phone.

- Enter the OTP code and press enter.

- You’ll be directed to your Capfin Self-Service Portal dashboard.

- Look for a section like “Statements”, “My Account”, or “Loan Details”.

- Click on it to view your current loan balance and a recent statement summary.

- You can choose to download a full PDF statement with detailed transaction history for a specific period.

Capfin Loan FAQs

Here are some frequently asked questions about Capfin Loans:

Eligibility and Application:

- Who is eligible for a Capfin Loan?

- South African citizens with a valid ID and permanent employment.

- Minimum age of 18 years.

- Minimum monthly income requirement varies depending on the loan amount.

- Good credit history is preferred but not always required.

- What documents do I need to apply?

- Valid South African ID.

- 3 latest payslips or 3 latest bank statements (not required for smaller loans).

- Proof of banking details.

- How can I apply for a Capfin Loan?

- Online through the Capfin website: https://www.capfin.co.za/

- At PEP or Ackermans stores.

- By dialing *134*6454# on your phone.

Loan Details:

- What loan amounts are available?

- Up to R50,000, but the actual amount you qualify for will depend on your affordability assessment.

- What are the loan terms?

- Short-term repayments of 6 or 12 months.

- Fixed interest rates that are transparently stated.

- What are the fees associated with Capfin Loans?

- No hidden fees, but there are administration fees and interest charges.

- You can find a detailed fee breakdown on the Capfin website.

Repayment and Management:

- How do I make repayments on my Capfin Loan?

- Through online banking or debit order.

- At PEP or Ackermans stores.

- USSD code *134*6454#

- Can I change my repayment date?

- Yes, you can contact Capfin customer service to discuss options.

- How can I access my loan statement?

- Online through the Capfin Self-Service Portal.

- By requesting it via email or SMS.

- Calling Capfin customer service.

Additional Information:

- Is Capfin a registered credit provider?

- Yes, Capfin is a registered credit provider with the National Credit Regulator (NCR).

- What should I do if I have trouble repaying my loan?

- Contact Capfin customer service immediately to discuss options and avoid late fees.

- Where can I find more information about Capfin Loans?

- Visit the Capfin website: https://www.capfin.co.za/

- Read the Capfin FAQs: https://www.capfin.co.za/faq

- Contact Capfin customer service at 087 354 0000.

Conclusion

Whether you prefer the immediate access and detailed control of the online self-service portal or the convenience of offline options like email or SMS, checking your Capfin loan statement in South Africa is readily available. Remember to prioritize secure practices and contact Capfin if needed. By staying informed about your loan details and ensuring responsible repayment, you can navigate your Capfin loan with confidence.

Image Courtesy: capfin.co.za