Unifi Loans South Africa is a reputable credit provider offering swift and hassle-free online personal loans to formally employed individuals. Whether you need funds to cover unforeseen expenses, consolidate debt, or make a significant purchase, Unifi Loans presents a viable solution. This guide will explore the intricacies of Unifi Loans, detailing its application process, competitive interest rates, and flexible repayment terms.

Understanding Unifi Loans South Africa: A Financial Lifeline

1. What Sets Unifi Loans Apart:

- Registered credit provider with a focus on fast and accessible personal loans.

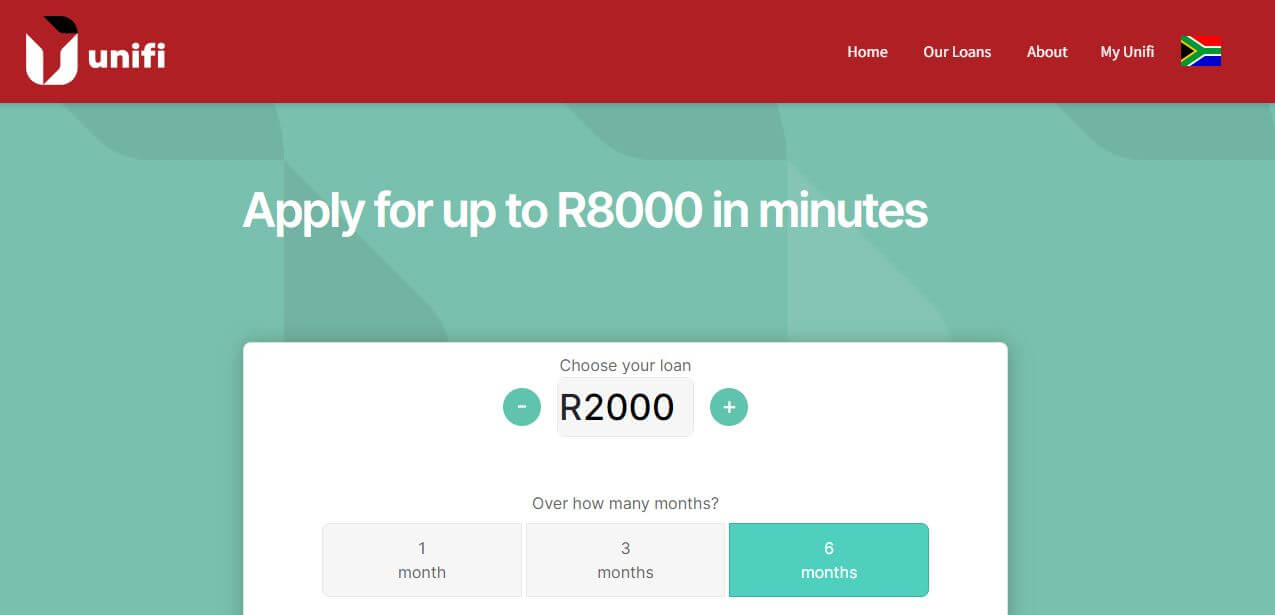

- Loan amounts ranging from R2000 to R8000 are available for application online, providing an immediate decision.

- Qualifying applicants receive same-day fund transfers to their bank accounts.

2. Flexible Repayment Terms:

- Unifi Loans offers a repayment term of up to 6 months, allowing borrowers to choose weekly or monthly installments.

- The competitive interest rate stands at 3% APR, which is notably lower than the average rate for unsecured personal loans in South Africa.

3. Eligibility Criteria:

- To apply for a Unifi loan, individuals must be at least 18 years old, possess a South African bank account, and hold formal employment.

- Applicants are required to provide proof of income and proof of identity during the application process.

4. Common Loan Uses:

- Unifi loans cater to various financial needs, such as covering unexpected expenses, debt consolidation, or facilitating specific purchases.

- It’s crucial to note that Unifi loans are not intended for long-term debt financing.

Benefits of Opting for Unifi Loans: Unleashing Financial Ease

1. Swift and Effortless Application:

- Unifi offers a user-friendly online application process, ensuring a seamless experience for borrowers.

2. Same-Day Approval and Funding:

- Qualifying applicants can enjoy same-day approval and fund transfers, making Unifi Loans a prompt financial solution.

3. Repayment Flexibility:

- Borrowers have the flexibility to choose between weekly or monthly repayments, aligning with their financial preferences.

4. Competitive Interest Rate:

- Unifi Loans boast a competitive interest rate of 3% APR, enhancing the affordability of the borrowing experience.

5. No Collateral Requirement:

- Unifi Loans are unsecured, eliminating the need for collateral, making them accessible to a broader range of applicants.

How to Apply for Unifi Loans: Navigating the Application Process

Online Application:

- Visit the Unifi website or app.

- Enter personal details like name, date of birth, and contact information.

- Choose the desired loan amount and repayment term.

- Provide proof of income and identity.

- Review and submit the application.

In-Branch Application:

- Locate the nearest Unifi branch through the website.

- Complete a loan application form in person.

- Provide proof of income and identity.

- A Unifi representative will review the application and run a credit check.

- Approved applicants receive funds on the same day.

Requirements for Eligibility:

- Minimum age of 18 years.

- South African bank account.

- Formal employment.

- Good credit history.

Repayment and Other Considerations: Ensuring Financial Responsibility

1. Repayment Process:

- Unifi Loans offer automatic deductions from the borrower’s bank account on the due date.

- Early repayments are permissible without penalties.

2. Late Payments:

- Missing a payment incurs a late fee.

- Communication with Unifi is vital if a payment cannot be made to explore alternative solutions.

3. Frequently Asked Questions: Addressing Common Queries

- Minimum and maximum loan amount: R2000 to R8000.

- Interest rate: 3% APR.

- Repayment term: Up to 6 months.

- Early repayment: Allowed without penalties.

- Eligibility criteria: Age, bank account, formal employment, and good credit history.

Conclusion: Embracing Financial Freedom with Unifi Loans

Unifi Loans South Africa stands as a trusted credit provider, offering a streamlined application process, competitive interest rates, and flexible repayment terms. Whether you’re facing unexpected expenses or planning a significant purchase, Unifi Loans provides a swift and accessible financial solution.

Note: Borrowers should adhere to legal and ethical standards when considering and managing loans. Seeking professional financial advice is recommended if faced with repayment challenges.