Tax Calculator is an online tool which helps taxpayers work out how much their monthly salary will be taxed for a particular year based on the South African budget. By using the Income Tax Calculator, you will be able to work out your salary tax (PAYE), UIF, taxable income, as well as what tax rates you will pay. In this article, you will learn how to use the Income Tax Calculator in SA.

ALSO READ: Home Loan Bond Calculators

What is an Income Tax Calculator?

An Income Tax Calculator is a free online tool to help you work out how much salary tax (PAYE) and UIF tax you will pay the South African Revenue Service (SARS) for this year, together with your taxable income and tax rates.

Any employee can use Tax Calculator SA to check their Personal Income Tax in South Africa. Income tax is the normal tax which is paid on your taxable income.

Examples of amounts an individual may receive, and from which the taxable income is determined, include:

- Remuneration (income from employment), such as, salaries, wages, bonuses, overtime pay, taxable (fringe) benefits, allowances and certain lump sum benefits

- Profits or losses from a business or trade

- Income or profits arising from an individual being a beneficiary of a trust

- Director’s fees

- Investment income, such as interest and foreign dividends

- Rental income or losses

- Income from royalties

- Annuities

- Pension income

- Certain capital gains

How to Use FREE Income Tax Calculator

There are many FREE Income Tax Calculators in South Africa online, for example, you can use Tax Calculator Old Mutual. You can use their income tax calculator to work out your monthly take-home pay. They also have a team of accredited financial advisers ready to help you save on income tax.

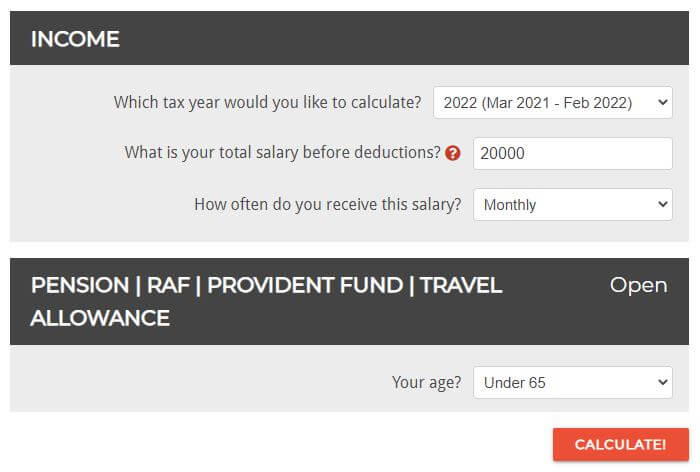

Just like the Old Mutual Personal Income Tax Calculator, many tools like the one from TaxTim ask the below information:

- Which tax year would you like to calculate?

- What is your total salary before deductions?

- How often do you receive this salary?

- Your age?

See the example below:

According to SARS, you do not need to submit your personal income tax return if ALL the criteria below apply to you:

- Your total employment income / salary for the year (March 2019 to February 2020) before tax (gross income) was not more than R500 000; and

- You only received employment income / salary for the full year of assessment (March 2019 to February 2020) from one employer; and

- You have no car allowance/company car/ travel allowance or other income (e.g. interest or rental income); and

- You are not claiming tax related deductions/rebates (e.g. medical expenses, retirement annuity contributions other than pension contributions made by your employer, travel).

Image Courtesy: stealthywealth.co.za